This week’s podcast is about a common playbook for a digital attacker (whether a digital native or incumbent).

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the Tech Tour.

Here are the 3 steps of the digital attacker strategy.

- Step 1: A new digital tool enables a superior service to emerge. This is used to break into an existing business. This often causes an unbundling of the existing offerings.

- Step 2: Existing value chains get transformed. Everyone scrambles to grab the valuable positions.

- Step 3: The new leaders add services, complements and bundles.

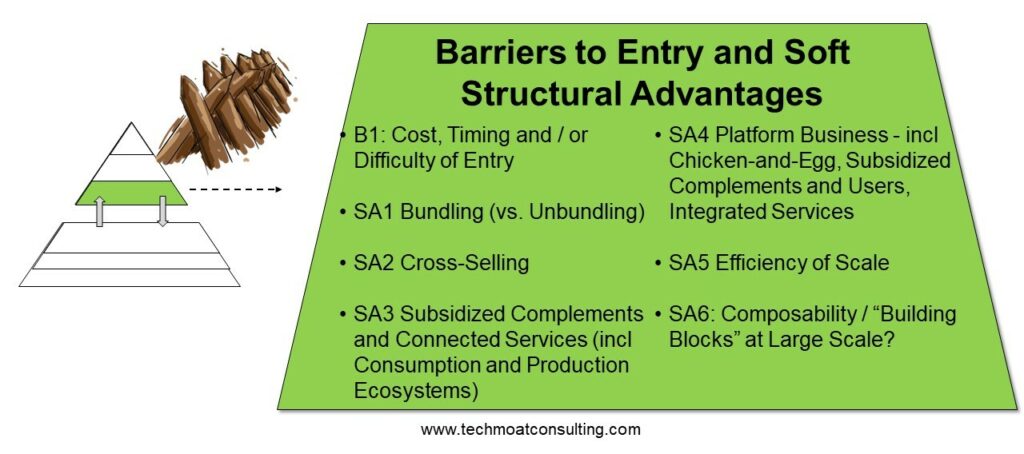

Here are the Soft Advantages I mentioned.

—–—

Related articles:

- AutoGPT and Other Tech I Am Super Excited About (Tech Strategy – Podcast 162)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Digital Superpower: 10x User Service

- Bundling / Unbundling

- User relationship

- Hierarchy of Control / Control Points

From the Company Library, companies for this article are:

- n/a

Photo by Johann Walter Bantz on Unsplash

——-Transcription below

Episode 214 – Digital Attack.1

Jeffrey Towson: [00:00:00] Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today, classic digital attacker strategy. So this is just kind of going to be, let’s call it digital strategy or innovation strategy 101. Very common sort of strategy for launching a new product or service, either as a digital native or an incumbent.

And you know, basically the three moves you make as sort of a standard Silicon Valley type strategy. It’s really common. So I don’t think this is going to be a long podcast, but it’s, you know, it’s worth talking about it. For those of you who are subscribers, I send you a I’ve got an email going into this in some depth today.

Basically I’m teeing up what would a generative [00:01:00] AI version of this strategy look like, which will be coming out in the next day to subscribers. So anyways, I thought I would just lay that out. Some of you this is going to be pretty familiar, others it might be the first time. But yeah, it’s pretty, pretty simple and pretty cool once you see it.

So that’ll be the topic today, just sort of the standard digital attack strategy that you see all the time. Let’s see, in terms of housekeeping stuff, we have the e commerce China tour coming up in either late October or early November. The details are over at TechMoatConsulting. com, and they’re in the show notes for this podcast.

If that’s something you’re interested in, take a look. A lot of retail, e commerce, You know, the thing about e commerce in China, like, it is the most interesting e commerce pretty much in the world. It’s kind of the epicenter. It’s very dynamic, very innovative. So there’s a lot to learn by looking at that those companies.

Second, it’s [00:02:00] kind of bleeding into other sectors. It used to just be retail and e commerce, but now it’s a lot of media. Content, advertising, social media, smart logistics, and now increasingly it’s sort of C to M consumer to manufacturer as well. So, I mean, this whole sort of e commerce focus, it’s really becoming interesting in a lot of sort of related industries like logistics and manufacturing.

You know, Xi’an is kind of a manufacturing story. So we’re going to talk about all that stuff and do a deep dive. If you’re curious, go over to TechMoatConsulting. com. All the details, including price, are there. Okay, let’s see. Standard disclaimer. Nothing in this podcast or my writing or website is investment advice.

The numbers and information from any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal, or tax advice. Do your own research. And [00:03:00] with that, let’s get into the content. Okay. So the concepts that would matter for today, I mean, bundling is a big part of this.

Bundling, unbundling, re bundling is a part of that. I’ve talked about that quite a bit. I won’t rehash that. Basically bundling as an idea has been around forever. You can bundle shampoo with conditioner and sell it at one price. It wasn’t a big deal in physical products and it was common in services.

A consulting firm might bundle a transaction service with a advisory service, things like that. That’s been around for a long time, but it really became important as an idea when we started to get to digital goods and services. Because most digital goods have very low marginal cost of production, so it’s very easy to bundle one, two, three, four e books together.

One, it’s a better product. You get a lot of [00:04:00] benefits. But two, it doesn’t cost that much, because usually the marginal production cost is zero. So bundling became a big lever to pull within software, digital goods and services. And you know, that’s anytime someone’s trying to sell you a subscription service like Netflix it’s usually a bundle.

I mean, that’s really what they’re selling. Netflix is a big, huge digital bundle. So anyways, became a big idea. That’s a big part of this strategy because as a digital attacker, you’re probably doing software or digital good with a limited operational footprint. Which obviously that’s a bit different.

Okay, so that’s kind of concept number one. The other one to think about is, if you look at my six levels of sort of digital strategy. Tactics, digital operating basics, digital marathons, barriers to entry, competitive advantage. One that I tend to skip over a lot is what I call soft advantages. [00:05:00] If you actually look at my charts you’ll see that I talk about barriers to advantage, I’m sorry, barriers to entry and soft advantages.

Now, barriers to entry, competitive advantages. The reason I separate those is because these are structural advantages. You know, you have a airplane, other people have a car. Your structure is more powerful. That’s different than being better as an operator. You have a more powerful machine. Well, soft advantages.

They’re kind of like barriers to entry, which are also structural advantages, which is a type of moat. But they’re a little bit different. They’re not as powerful, but I do think they create structural advantages versus competitors, both rivals and new entrants. So there’s a little bit of a list there that I kind of skip over.

Usually I talk about barriers to entry, but under soft advantages, if you look, There’s three or four that I’ve listed. One is bundling, [00:06:00] another is cross selling, another is creating sort of limited connected ecosystems like a consumption ecosystem or a production ecosystem where you’re basically as a product or service connecting with other companies and jointly selling.

Well that is a structural move that can often create advantages at the company level, at the product level, at the service level, so most everything I’m talking about today is under that bucket. Bundling, cross selling, unbundling. A business model with sort of a significant degree of connectivity with other companies, partners, product services, things like that.

So that’s kind of the second bucket in terms of concepts for today. All of that’s sort of on the concept library. You can find it. Okay, let me just jump to the so what. What is the classic digital attacker strategy? Now, a digital attacker, [00:07:00] which is what’s going on in Gen AI, is someone’s coming up with a product or service that changes the game.

You know, maybe it’s a product or service that already exists, like renting a hotel, but someone has just used digital tools or a digital business model that’s new to create a far better version of that, like Airbnb, or Expedia, or something like that. So it’s always like some new digital tool or technology or business model emerges, and suddenly we have a really compelling service or product that is either entirely new, like Twitter.

Twitter was something completely new. There was no pre release. Newspaper version of Twitter, or okay. It’s an existing service like renting a hotel, but it’s just much better. Netflix was a, you know, Netflix didn’t create a new [00:08:00] tool or anything. It just, it took some digital tools and came up with a clever business model that made renting Videos at a store, pretty much obsolete.

So we’re looking for digital change that enables a new product or service to sort of rock the world. And, you know, that’s usually step one. And I’ll list the steps in the the show notes, but let’s say step number one, a new digital tool enables a superior product or service to emerge. And this enables either the digital attacker who could be a startup, Or it could be an existing company that came up with a new product, but it enables them to break into an existing business that probably had entrenched competitors.

You know, the hotel business wasn’t anything new, but Airbnb, Expedia, Ctrip, Booking. com, they all sort of, [00:09:00] you know, used it, you know, digital tech to break in. If you don’t have that sort of advantage, often enabled by a new technology. Sometimes it’s enabled by a new regulation. That’s a new, a government change will also often create a window for an attack.

But if you don’t have that, going against incumbents is usually quite difficult and you usually don’t win unless they’re lazy or not well run. That does happen, but it’s pretty rare. One example of that would be Zoom. Zoom didn’t actually create anything new. Video conferencing had been around for a long time.

It just turns out that the dominant players, of which you kind of got to point the finger at Skype, were just sort of badly run and their product wasn’t very good. And Zoom didn’t create anything new, they just created a better version of Skype. And [00:10:00] it was so much more convenient and pleasant to use that they broke into a space they really shouldn’t have been able to break into.

So sometimes that happens. But usually for this, it’s a tech change or regulatory change that opens the windows. That’s kind of what China is doing with electric vehicles right now. They haven’t really been able to break into global auto sales, even though they’ve tried. Not very much. Well, electric vehicles have created the window and they are pushing hard.

So anyways, that’s sort of step number one. You see a break in. Now, one, you break in against incumbents and two, and this is kind of, I guess, the important part for this discussion is that will often lead to an unbundling. of services. Usually there’s an incumbent in play. They’re not offering one service.

They have quite a few services they’ve built around this, and often they are bundled together and sold at [00:11:00] one price or they cross sell. When a digital attacker breaks in and carves out a key service like that, often the bundle starts to come apart. So example of that would be let’s say traditional travel offices.

You know, it used to be if you wanted to take a trip to Europe and you were in the U. S., you would go to a travel agent. And you still see travel agents physical offices in a lot of places. And, you know, what do travel agencies do? Well, they have a suite of services. They sell you the airline ticket, they sell you the hotel, they try to sell you some tours.

And they will cross sell, but often they would create bundles. If you get this ticket, we will get you two nights of hotel and a three day pass to Disney World, right? They will create special bundles and promotions. And that was a lot of what they did. And. That was a fairly effective business model until Expedia and Agoda [00:12:00] and you know, these OTAs, these online travel agents emerged.

But they didn’t really take the whole suite of services, they just really took the hotels. for the most part. Now they also helped you with the flight bookings, but there actually aren’t that many flights. The power of these OTAs is overwhelmingly in the hotel bookings. So they created a far superior version of this using a platform business model, and they carved that service out of the traditional travel agent business.

And it was pretty devastating for them. So one, it was a far superior service. They carved it out, but two, it really punched a hole into the traditional travel agent model and their service suite and their bundles suddenly fell apart. And that’s important. So that’s sort [00:13:00] of step number one in all of this.

But then we get to step two, which is I think the strategy part of this. Nothing I said is terribly interesting so far. That step two is. The existing industry structure, the existing value chains, and sometimes the entire ecosystem can fall apart or get reshuffled. And that forces everybody in that industry, the attacker, and the incumbents who maybe have been sitting pretty for a while.

Everyone scrambles to identify the valuable locations in the new industry structure. So if we go back to just, you know, standard Michael Porter 101, you know, an, a business sits within a value chain. Usually an industry is a value chain. It’s a sequence of activities where every step adds value. It’s, [00:14:00] You know, in simple businesses, it’s considered a linear business model.

Everybody adds value and then the end product is valuable to the customer. Okay, how do you find the different steps in the value chain? Why is in, you know, if we look at sort of traditional retail, we might have manufacturing as the starting sort of activity of the value chain. Then we might go to inbound logistics.

We might go to the retail step, then to marketing and sales, then to after service. That would be a, you know, a standard linear business model value chain. Okay, how do those segments of the value chain get determined? Well, a large part of it is what we would call coordination costs and transaction costs.

Let’s call that the, the bottlenecks. As you know, a product or service is created by an industry, certain [00:15:00] steps are harder than others. Maybe coordinating with another party becomes difficult. The transaction cost, the expertise. Those sort of speed bumps and bottlenecks, which we call high coordination cost points.

That’s usually what determines the the value chain and why company A may be a retailer but would not go into manufacturing, and company B might be in logistics but not in retail. Those segments along the linear sort of value chain are usually determined to a large degree by where you have these high coordination costs.

Now, coordination costs is something we talk about in digital all the time. Because marketplace platforms, most platform business models like Alibaba and Amazon, they are in the business of decreasing coordination costs. That’s what they do. Amazon, well, the [00:16:00] marketplace doesn’t sell anything. They just connect you with another party selling something and they enable the transaction by dropping the coordination costs.

Which is all Alibaba does. That’s what digital tools are very good at. So the same thing kind of happens here. When a new digital attacker appears, often what they will come in and do is they will use digital tools to wipe out a significant coordination cost. Like, why do you go to a traditional travel agent?

Well, because, you know, you would have to call the airlines and find the best price across 20 different airlines, or you would have to call all the hotels and get the best price and maybe find the reviews. There’s a lot of information asymmetry. There’s a lot of searching costs. All of that goes under the banner of, you Coordination costs.

Hence, the travel agent would emerge. But why wouldn’t the [00:17:00] airline also have a travel agent? Well, there’s different costs. The exact things we’re saying that the digital attractor is going to wipe out is not only going to create a better product or service, it’s also, in some cases, going to wipe out those coordination costs and basically reshuffle the industry.

It will change how the value chain is set up and it can really change an entire ecosystem, if you’re talking software systems. So as, you know, that’s kind of the point I think people don’t appreciate enough that value chains and industry structure to a large degree are created by coordination costs between activities.

But digital tools are very good at wiping those out and therefore changing the structure. Anyways, so that definitely happened, let’s say, with Expedia and these companies. They didn’t just create a better product, they completely transformed how people [00:18:00] do travel bookings. And we could come up with lots of other examples of this WeChat and WhatsApp.

Now their product was better than making text messages on your phone using your mobile carrier who would charge you per text message. And that used to be how it worked. And then WhatsApp and WeChat basically made that free. Far better business service. But at the same time, they also pretty much reshuffled the industry because WeChat didn’t just stay in the text message business, it does group chats, it does e commerce, it does payments.

So, you know, they kind of hit both. Facebook is definitely one. Facebook is a big example of this, where. You know, it used to be, you know, Facebook does a lot of things, but one of the things they do is news. They’re a news site. So is Twitter. It used to be that the biggest player in news [00:19:00] was the local newspaper.

The New York Times in New York, the Boston Globe in Boston the Tribune in Chicago. Every city had a monopoly. with a print newspaper that was arguably one of the most powerful business models that existed. Buffett has said it was probably the single most powerful business model that existed was local newspaper monopolies when it was print.

And what was the newspaper? It’s a bundle. That’s what it was. They had a sports section and a news section and a weather section and a classified section. Well, eBay came along and so did Craigslist. They created a better version of the classifieds and moved it online. That’s sort of step one and they carved it out.

And pretty much every section of the classic newspaper got carved out. But within news, [00:20:00] Facebook came along and you know, if you want to read news now, most people go to Twitter or they go to Facebook or they go to YouTube, but you know, that part got carved out. As a better service, but it also reshuffled the entire news industry and newspapers, even to this day, are struggling to find a profitable position within a reshuffled industry based on what Facebook and Twitter and these companies did.

And, you know, there’s these laws they’ve passed, like in Canada and Australia, where they want to make Facebook pay the news companies if they repost their stories. Which is kind of dopey. And it’s like, look, you don’t understand this. Facebook doesn’t need your news stories. You need Facebook now. The news companies, they work for Facebook.

They are not only reshuffled the industry, but they took the prime position that you want. [00:21:00] So when an industry gets reshuffled, the first question that comes up is is where are the attractive positions located? Where are the positions that give us control? Where are the positions that we can make money?

And it’s very difficult sometimes to identify those positions. Now in the old industry structure of newspapers travel agents, everybody knew where those position was. Right? Everybody knew you wanted to be the local newspaper. Everyone knew you didn’t want to be the people selling ink to the newspaper.

Well, when it gets reshuffled, there’s, there’s a question of where do you want to be in the new ecosystem? So that’s step two. The industry gets reshuffled sometimes, the existing bundles of services get broken up, and everybody scrambles to find the new position. And here’s a couple positions you could think about, and this is not my thinking, this is from I’m [00:22:00] paraphrasing, but this is from Sanjeev Choudhary, the platform revolution guy, very good thinker, based in Singapore.

You know, the phrases he uses are, You want the primary user relationship, that’s always the best position to have. You want to be the place that all the customers go to, usually consumers. If you have that position, okay, you’re in good shape. Everyone goes to Facebook to get their news. They don’t go to individual news sites.

That’s the, you know, that’s the power position. Now for a company like Expedia, they did very well in terms of their product and in sort of disrupting, reshuffling the industry, but they didn’t really get the primary user relationship. Most, a significant portion of their traffic It comes from Google search and then Google search forwards it on to them.

So the amount of money they spend on digital marketing [00:23:00] is crazy. So yes, they did well, but they’re, you know, people just don’t buy plane tickets and often enough for them to really command the user relationship in a powerful way. Everyone logs into Facebook every day. Everyone goes to Google search every day.

They don’t go to Expedia or booking every day. So they didn’t actually get that point. And it’s it’s an ongoing problem for them. So the primary user relationship, obviously you want that. There’s other control points you can have within an industry, especially on the B2B and the enterprise side.

You can have APIs that everybody uses. You can have a scarce resource that everybody needs. You know, like TSMC. There’s other ways to have sort of a control point within the ecosystem or with the industry that gives you a significant amount of power. And keep in mind, [00:24:00] in most industries, it’s not just one company that makes money because they’re in a good position.

It’s usually a handful of companies. This is the same. So you’ve got to sort of identify the user interface, the That matters. The control point. There’s usually several of those. The example I always give to people is the port of Los Angeles. is a choke point. If you’re shipping into the western United States on ships, there’s really only one major port on the west coast, which is Los Angeles.

Otherwise, you got to go through the Panama Canal and come into the Gulf of Mexico, which is more expensive. The unions of the Port of Los Angeles know this, and the unions go on strike every now and the dock workers and things like that, and they do really well. Because it’s a control point and they can shut it down.

So these control points are in a lot of places. The Houthi in Yemen are basically using a new [00:25:00] type of technology, cheap missiles to, to some degree, take control of a control point and nobody’s been able to stop them thus far. So that’s, anyways, think about control points. Think about who controls the primary user interface versus the secondary position.

Those are going to matter. So that’s kind of step two. A great digital product by an attacker can not only create a new service, it can sort of reshuffle an industry. And then the key question you always have to ask is, what are the key positions that we got to get to? That’s a really good question. When you think about innovation and digital strategy, can you identify before anybody else where the key positions are in this new emerging industry or ecosystem that you want to be at?

That’s really a good strategy question. Actually, that’s the kind of thing a guy like me gets a phone call [00:26:00] for. Okay. That’s step two. Now, step three, let’s say a company like WeChat. Okay, you’ve, you’ve disrupted, you’ve got a better service, you’ve broken into an incumbent industry, the industry’s been reshuffled, and you’ve captured a valuable point.

Step three, basically, is land and expand. Once you have one great service that you’ve managed to use to break in, then you want to start adding more services. You want to start adding compliments and you want to start to rebundle, right? There are people that argue that the only way to really make big money as a business is by bundling.

I’m not convinced that’s true, but it is frequently true that, you know, as you’ve got one service like your WeChat, And you’ve got the primary user interface, text messages, and then you add group text and things like that. Well [00:27:00] then you start adding other services that are related, usually. Usually you start with compliments.

So you start to do something like payment. You start to do sharing video. Those are kind of related, but you can also add services that are not necessarily compliments. They’re just other services that your customers might want, like e commerce things like that. And you start to offer this and you start to basically, it’s like, we call it land and expand.

You know, you land with your core key service and then you expand into other services, which can be lots of things. It just creates. A lot of power for multiple reasons. But really within there, the most powerful move is to create bundles. So it’s like a digital tool or technology can break into an industry, break up an existing bundle, then the industry gets reshuffled and the new sort of key positions emerge.

[00:28:00] The leaders grab those and then they start to rebundle. It’s really common. So why would that be powerful? Well, let’s say, your WeChat. You’ve added lots of services and you start adding bundles. You start saying, you know, we will have a membership program that will get you better services in payment, e commerce, gaming, and I don’t know, chat.

And you can start to bundle all of those things together into offerings that your competitors who don’t have all of your services can’t match. Bundling is a really powerful move. Number one, it usually creates a better service. Buying hot dogs is only part of why people buy hot dogs. They actually don’t want that.

They want hot dogs and buns and mustard. But usually one com, you know, one [00:29:00] company offers each. Well, if you can offer all three, that is a better customer solution. You’re solving more of the customer’s problems in one shot. So one, it’s a bundle is generally a better service. Your cable package of 200, 300 channels, even though people like to complain about it, is actually a better service than just getting 20 channels.

Even at the same price, it’s actually a better deal when you do the numbers. So a bundle is a better service, for sure. Microsoft Win, let’s say Office, is a better bundle. Service because it has Excel, Office, I’m sorry, Windows. Excel, Word, and PowerPoint than just buying one. The other reason bundles are a big deal.

They create a barrier to entry. They are a structural advantage. You know, once Microsoft Office was created and you got Excel, Word, and [00:30:00] PowerPoint for 1, 000 instead of 1, 500. Lotus Notes, which was actually more more popular than Excel. was in serious trouble because for them to stay in the game, they had to offer two other services they had no expertise in.

So they either have to build it or acquire it or whatever. But usually, you know, if you’re building a barrier that stops people from jumping into your business, three linked services as a bundle is a higher wall to jump. That’s two. The other thing it lets you do when you bundle, and really this is not just bundling, but anytime you have a suite of related services, you can start to do price shifting and subsidies.

You can start to do things like, well, our primary competitor Lotus Notes only has, you know, this numbers program. So why don’t we give away Excel at a big [00:31:00] discount and we’ll make our money on PowerPoint and Word, you know, you can shift the money. And you’ll still do fine but it’s brutal for Lotus Notes.

So you can start to shift and give subsidies and sometimes you can even give one of your services away for free. Now maybe you give away one service for free because people really like it and it gets them in the door. Freemium. Or maybe you give away one of your services for free because it’s a good way to crush a competitor.

And they can’t afford to give away their only service, but you can because you have three services. That’s kind of what Facebook is doing. This is often referred to as scorching the earth. The All In podcast was talking about this a couple of weeks ago. Why is Facebook giving away basically their foundation models?

Generative AI. Why are they giving away? Why are they open sourcing? Because they don’t make their money there. They make their [00:32:00] money in their newsfeed and other places and really in Instagram. But they know that OpenAI makes all of its money. So let’s build those and we’ll just give that one away for free.

Now, it’s probably not going to crush them, but it definitely hurts their ability to charge. It’s kind of a scorched earth strategy. You know, companies have been doing that for quite a long time. Microsoft kind of has been doing this for a long time if you, you know, I talked about this before. If there’s a, and this was an all in podcast discussion, like if there’s a hot new service that has emerged, Microsoft just bundles it with their existing stuff, which you’re already paying for.

So you kind of get that for free in your mind, which is devastating to the standalone company. That just emerged and Slack has kind of been wrecked with this approach until they had to basically, you know, sell themselves to Salesforce Anyways, that’s sort of three. The third point is, you know, you come up with a good product That’s [00:33:00] number one The industry gets reshuffled when you grab the key position if you can then you start to you know Add services and rebundle as much as possible and you want to become sort of the ultimate resource in your area You know Alibaba is unbelievable at this I mean, Alibaba offers, they’re the ultimate B2C marketplace.

They’ll sell you products, laptops, makeup, anything you want in terms of physical products, but they will also offer you digital goods like movies, and they will offer you services like food delivery. I mean they are just adding service on top of service on top of service and then they’re creating all these bundles all over the place.

If you buy these two products, here’s a third one. If you have this service, we will bundle this with a VIP membership. That extends to Taobao and, you know, Olima and whatever. So there’s a ton going on with them in terms of services and bundling. Anyways, that’s pretty much it. [00:34:00] That’s a standard strategy.

You know, the more connected a model is now one last point, and then I’ll, I’ll finish here. The more, you know, I, I talked about this basic digital attractor strategy in a very linear business model type of way. As you start to move to platform business models and ecosystems, those are basically business models or industries that are far more connected.

There’s a lot more connections. Generally, the more connected a business model is, the more powerful this approach becomes because you can link more services. So keep that in mind that, you know, figuring out where the powerful. and or profitable position is in a business like Slack or in a business like Adobe is pretty straightforward because the business models are pretty simple.

Figuring out where the powerful and or profitable position is [00:35:00] in something like, you know, E commerce or social media meets e commerce or entertainment meets e commerce, which is basically TikTok shop. That’s much harder to find out. It’s very, it’s harder to figure out where you need to end up because it’s a much more complicated version of this question.

It’s kind of like checkers versus chess. This is a lot more complicated. So ecosystem strategy is pretty complicated. Anyways, that is it for today. Hopefully that’s helpful. Those of you who are subscribers, I’m going to send an article in the next day, basically applying that to generative AI.

Cause I think that’s one of the big questions, which is, where do you want to end up? Where is the valuable position long term that you want to get to? And that’s kind of what I’ve been working on, which is why I was thinking about this this week. Anyways, that is it for the content for today. The two key concepts again bundling, [00:36:00] and this sort of just idea of Soft advantages.

Things like bundling, things like cross selling, things like connected business models. I put those all under soft advantages as sort of structural advantages, but not really the same as a competitive advantage. Anyways, that’s all in my frameworks. You can see it there if you look. And that is it for the content.

Let’s see, any fun stuff? I saw a movie the other day I thought was really good was Equalizer 3. You know, they made these movies, The Equalizer, which was based on some old TV show. And it was, the first one was pretty good, the second one was kind of terrible. The third one was quite nice.

Like, I’d heard it was good. Someone said, watch it, give it, I’m like, I don’t want to see that movie, The Equalizer, whatever. And they’re like, no, no, go see the third one. I watched it, it’s it’s pretty good actually. Like, it’s violent because it’s a, you know, Denzel Washington’s a retired hitman or CIA or something and, you know, he defends like [00:37:00] a small Italian town from gangs and stuff.

So it’s violent but it’s actually really nice. It’s set in sort of the southern coast of Spain in an area I really like. So yeah, that would be a, that’s a recommendation. It’s on Netflix too, it’s easy to watch. So yeah, Equalizer 3, but I would say skip the second one. The first one’s okay. But the third one’s far better than I thought it would be.

Anyways, I guess that’s a recommendation. That’s it for me. I hope everyone is doing well and I will talk to you next week. Buh bye.

———-