This week’s podcast is Huawei’s recent 2022 financial results and big event.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here are my three take-aways:

1. The Core ICT Business Is Stabilized and Focused on Continuity, Resilience, and Quality.

2. Cloud Revenue More Than Doubled to +45B RMB in 2022. This is Now Huawei’s Biggest Growth Opportunity.

3. The Hard Hit Consumer Business Revenue Stabilized at 214B RMB in 2022. This Was Surprising.

Here is the link to the TechMoat Consulting.

Here is the link to the China Tech Tour.

Here are some slides from the presentations:

—–

Related articles:

- My Interview with Huawei’s Guo Ping on Managing People vs. Managing Rules and Systems (Tech Strategy – Daily Strategy)

- 3 Types of Network Effects (Asia Tech Strategy – Daily Lesson / Update)

- Questions for Huawei’s CEO, JD & Jingxi, Metcalfe’s Law Is Dumb (Asia Tech Strategy)

From the Concept Library, concepts for this article are:

- n/a

From the Company Library, companies for this article are:

- Huawei

——–Transcript below

Episode 160 – Huawei.1.transcribe

Fri, May 05, 2023 11:26AM • 38:14

SUMMARY KEYWORDS

huawei, number, company, business, china, renminbi, put, r&d, years, revenue, cloud, carrier, event, people, smartphones, semiconductors, tech, ericsson, political, shenzhen

SPEAKERS

Jeffrey Towson

Jeffrey Towson 00:00

Welcome, welcome everybody. My name is Jeff Towson, and this is the tech strategy podcast or we analyze the best digital businesses of the US, China and Asia. And the topic for today, three lessons from walkways 2022 Financial Report. Now every year around this time, Huawei does sort of an annual meeting big event in Shenzhen at the headquarters. And they they talk about their financials for the year and issues and we get a management report and CFO and all of that. I mean, it’s a private company. So it’s not, you know, the degree of information is nothing like a public company, but it’s actually quite good. And it tends to be very helpful for sort of understanding where their strategic thinking is going, because they really talk about what they’re focusing on. And they’re pretty open about it. It’s pretty good time, actually.

Jeffrey Towson 00:56

So anyways, I flew out for that, I thought I would talk a little bit about what I learned the event, which was really cool. And then just sort of the key takeaways. And I’ve been writing about Huawei and talking about Miss almost 10 years. I mean, I wrote about them in my first sort of China book, the one hour China book, as you know, just an example of a really well run company. And we went back to when it was founded by Ren, ZHANG FEI in the late 1980s. And what they were doing and how they kind of grew step by step. Really cool, interesting business case. And then, of course, it became very political a couple of years ago, as they found themselves in the center of this sort of US China, quote, unquote, tech war. Really, you know, really, not by anything, they themselves actually did. They just kind of found themselves at the center of the storm. And, you know, rightfully kind of asked, like, what did we actually do? And it’s like, well, nothing. But you know, it’s symbolic. It’s what it could be what what it might be, but it’s not unlike the situation with tick tock right now.

Jeffrey Towson 02:08

They are sort of now at the center of the political storm. And

Jeffrey Towson 02:12

they are also asking, like, you know, what exactly did we do that you don’t like? It’s like, well, nothing, but you could, you might, you know, it’s not what you did? It’s who you are. And, anyways, that’s kind of the nature of it. I think that the Politik, if you haven’t picked this up already, I think the political aspect of Huawei in particular. There are important questions there. I don’t doubt that I think there are reasonable questions, I think telecommunications has slowly evolved into something that was cables connecting various buildings to really what we would call digital infrastructure that affects almost everything. So it has become a very sensitive subject sort of naturally on its own. And there are lots of good questions that you should ask. But having said that, I think the political angle has been overblown. And I think there’s a tendency to see literally everything about Huawei, through a political lens. And I don’t know, maybe that’s just because the topic went from the pages of The Wall Street Journal to, you know, more political newspapers, like, let’s say, The Washington Post or DC, I also think has to do with the fact that most people, a lot of people, they don’t know much about this company besides that. So that’s kind of what they talk about. Anyway. I think it’s a very interesting company. And I’m probably not going to talk about the political stuff. I think that’s been hashed out. It’s not terribly interesting. So I’m going to talk about the business case, you know, Huawei versus Ericsson vs. Nokia, telecommunications, 5g to five point 5g 560s coming up on the horizon. Pretty cool lot going on in the business case. So that’s what I talked about. Okay, with that long sort of data, no qualifier, I suppose you could say, let me get in. Oh, let me do my standard disclaimer here. And nothing in this podcast or in my writing or invest. Our website is investment advice. The numbers and information for me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. Okay, let me get into the topic.

Jeffrey Towson 04:24

Now, I don’t really have any

Jeffrey Towson 04:28

digital concepts for today. I mean, I’ve talked about Huawei a lot. If you go on the on the website. I mean, there’s a ton of articles about Huawei. The strategy bid is relatively straightforward. It’s a lot of economies of scale and manufacturing and sales and ultimately r&d. It’s going from a traditional equipment manufacturer to something that is more of a smart, manufactured products business. Suddenly its connectivity, its edge devices. They’re moving into cloud. They’re kind of moving into AI but they’re really seeing that

Jeffrey Towson 06:09

a tiss a lot, you know, in the Middle East, or wherever. So I mean, they’re very good at what we’d call like b2b sales, which often has a, you know, relationship aspect, a presentation aspect. So when they put on event, they know how to do this. And sure enough, their annual event, their annual report was pretty great. I went out there. And that was kind of fun, because China has opened up again, and this was my first trip back into the country since the COVID. stuff. And you know, all the visas are active again. And so that got all very easy, very quickly, I still got pulled over on immigration coming through, which was never happened before in China, I get pulled over every now and then from immigration, they they pull you aside, say, hey, we want to talk go sit over there. And then when officer comes over and your talk, the longest I’ve ever been sort of detained was actually by US Customs on the Mexico border, where they kept me for like, an hour or two. And it was this was, you know, I thought it was gonna be Oh, it’s visa or whatever. And no, isn’t the issue turned out to be I didn’t really look like my passport photo, because I had a beard. And

Jeffrey Towson 07:16

like, they basically couldn’t tell it was the same person while they let’s say they struggled with it, which is there’s a good joke in there somewhere about like, you know, the standard joke of, let’s say, white dudes in the US, you know, can’t tell, let’s say people from Asia apart, which is broadly true. Well, it works. The other way to most folks in Asia can’t tell. You put 10 white dudes in a line, they’re going to struggle a little bit so they couldn’t tell it was me. I literally had to put a piece of paper over the bottom of my face and put myself and my passport next to me. And then they’re like, oh, okay, so that only took 15 to 20 minutes to get that sorted out. But other than that is fine. And, you know, Shenzhen is a great city. That’s where they have their main headquarters. They have their r&d facility, which is the sort of spectacular European town that they built up in Dongguan, which is nearby. Great. I mean, Shenzhen is really fun. So anyways, went to that, you go to the big event, they have sort of

Jeffrey Towson 08:17

French like palaces and statues. And this is all as far as I can tell, because Ren Zhang Fei, the founder just really likes Europe. And if you’re going to be a super rich guy with a lot of money, you might as well build buildings that make you happy. I mean, there’s nothing more boring in life than super rich people who aren’t eccentric, like it’s feels like kind of a waste. So if you go there, there’s all these statues and you know, kinda looks like Versailles a little bit in places and there’s French chateaus on the grass and there’s lakes, then it’s really pretty awesome. Anyway, so that was it. So go up there. And then they had the big event I actually interviewed Guo ping, who is I interviewed him a couple years ago back when he was chairperson of Huawei. But now he’s moved on to another role, which is President of the Board of Supervisors. China, China operates like

Jeffrey Towson 09:10

Germany, and a lot of Europe where they have sort of a two tiered board system, they have the board of supervisors and the board of directors. So that’s China. It’s actually mandated by law, but it kind of varies in practice a lot. It doesn’t always mean anything, but they actually gave him and the board a fairly compelling role in terms of training and developing leaders. And whenever I sort of tucked a walkway or go visit, like, the number one thing I always want to know about is human resources. I think that’s what they do best. I mean, the tech is cool, and you know, the base stations and all that stuff is fun to see in the VR glasses and they do make spectacularly nice smartphones, flip phones, but I mean, it’s their human resources policy and their compensation and how they organize. They’re now 207,000 employees. That’s really what they’re

Jeffrey Towson 10:00

they’re best at. And that’s how they are so fast on their feet. And there’s so I mean, they’re known as being a very aggressive company, even by China standards. That’s all comes out of the Human Resources policies and how they sort of develop people. And that’s always what I want to talk about. So, and it was I sat down with Mr. Wall, and we talked about his roll on that I wrote that up for the subscribers. I think it’s pretty important stuff. It reminds me a lot of 3g capital. You know, the Brazilian group that they would basically buy relatively simple businesses like beer companies, Kraft, Heinz ketchup, you know, low Haas Americana, which is now having interesting questions in Brazil. But they these are relatively simple companies in terms of tech, right, it’s beer. And then they would supercharge the management with their sort of meritocracy plus partnership model. They were basically perform shock therapy on the culture and supercharge the management. And you can do that quite easily. If you’re doing Burger King, which they did, you’re not going to break anything. It’s a lot like that. The difference is Huawei pretty much did the same approach. But they applied it in a very technology intensive field, it’s one thing to give sort of cultural shock therapy to a bunch of people bottling beer, it’s another to do that to a company that’s, you know, 80 to 100,000. Engineers, I mean, this is a tech company that has to continually recreate its products every three to five years. Okay, that’s a different challenge, and especially doing it at this scale. I mean, you’re talking about hundreds of 1000s of people. And that doesn’t even count sort of the contractors that do a lot of the service work, but it’s probably a couple 100,000 more. So applying that sort of model is really almost unprecedented. I can’t really think of any other company that does it this aggressively. So there’s a lot of lessons there. I when I look at companies like Apple, Facebook, you know, they look to me, like very, very slow compared to a tech company like Huawei. You know, I don’t see the same culture, I don’t see that sort of incentive structure really driving people. There’s a couple of companies that maybe have this similar, but not many, it’s pretty rare. Anyways, so that’s kind of been my standard topic, talked to him about that. That was Friday morning, then Friday afternoon, they had their big event. So you go over lots and lots of people, big huge screens. That’s kind of the funny part is that I had all these awful events, the tech is always really good. Like the screens they put up are fantastic. And now the town cars that take you around all have really good Wi Fi, which makes sense, because they’re a telco company, so that the tech is actually always really impressive. Anyway, so they go through the event. And it’s Eric Xu, who’s, you know, they have these three to four rotating chair, people that sort of hand off, not power, but leadership on a regular basis. And he’s been there for quite a while. And then Sabrina Mung who obviously had all those issues in Canada, well, she’s back as CFO. And she officially took over as a rotating chairperson, I think, on the second like so literally the same day or the next day. So she gave a talk, and it was in lots of q&a and stuff like that. And it was a lot of fun. And I’ll sort of give you my my three takeaways. Let me give you the standard story. First, this is an it’s reasonable. This is the basic story that they were telling, this is the basic story you’re going to see reported. And I more or less agree with it, I think it’s directionally right. And then I’ll tell you sort of three things I think are important that our people aren’t really talking about. So the basic story is sort of back to business as usual, like, quote, unquote, back to normal. You know, there’s big political impact, external factor impacted, decent amount of the business, they had to do a lot of restructuring. They had to redesign a bunch of components, they had to patch the holes in their supply chain, where they could in certain places they couldn’t notably semiconductors is the issue and operating systems. They also had certain business lines that were more impacted in those. Okay, that’s been two years of that.

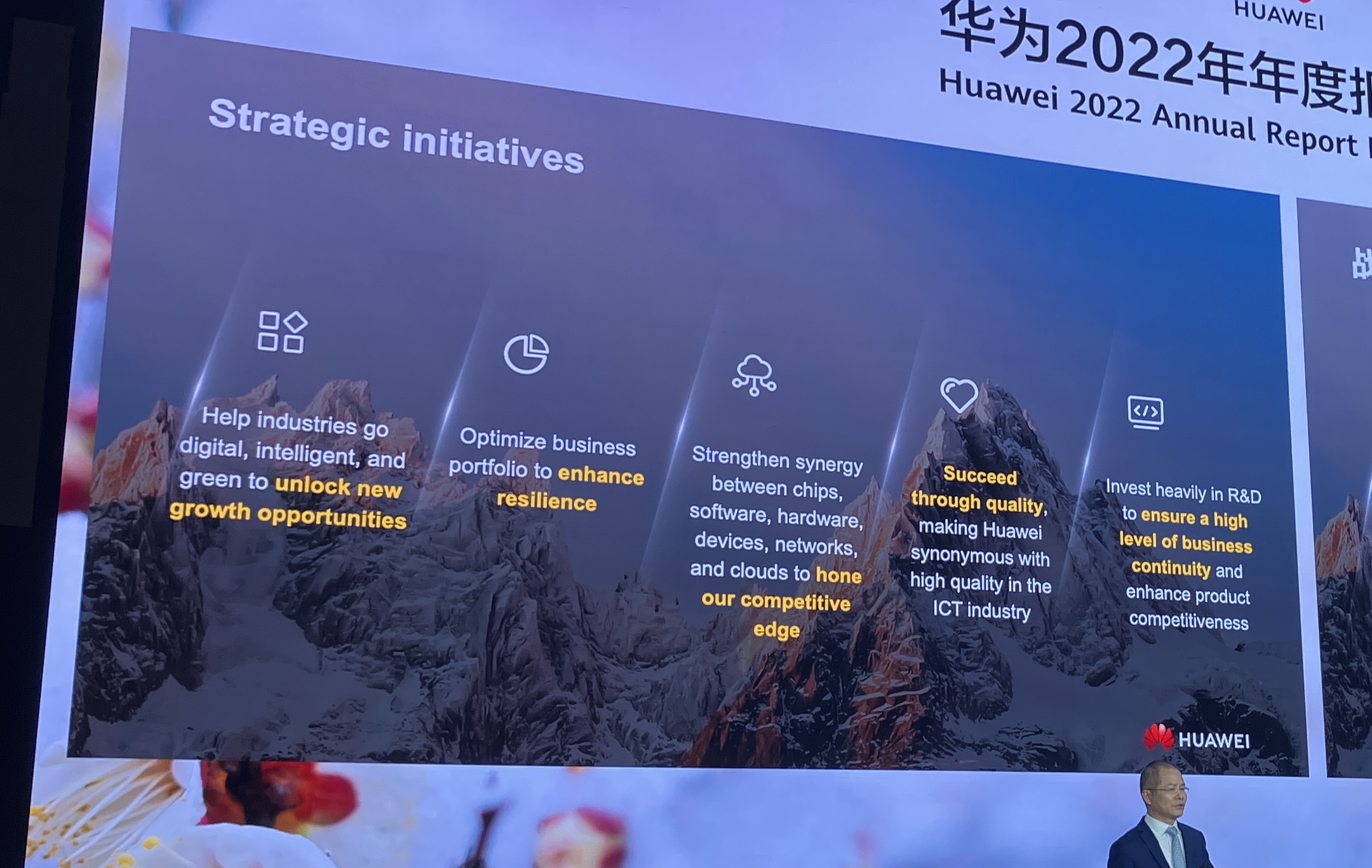

Jeffrey Towson 14:20

2002 Here’s a quote from Sabrina Hmong quote in 2002 2022, sorry, Huawei gradually pulled itself out of crisis mode, US restrictions are now our new normal, and we are back to business as usual, unquote. And that’s pretty true. Here’s a couple of factoids from their financials. Revenue was 642 billion renminbi. And that’s pretty similar to 2021 2021 was 636 billion, so it went up to 642 about the same. Now why is that important? Be Because 2020 to 2021, the year before, there was a significant 29 to 30% Drop in their revenue. I mean, that’s when they took the hit. So that looks like it has largely stabilized, or at least it’s holding solid. And most of their revenue comes from two places, it comes from ICT, their carrier business, which is about 354 billion, so more than half and then the consumer business, which is 214 billion, those are 2022 numbers, that’s where most of their revenue is coming. So that’s kind of point number one, look revenue is stable, or at least stabilized for now, which is a, you know, a contrast to what happened 2020 to 2021. Okay, second point, operating profits dropped to about six to 7% of revenue and 2022. And that was technically a significant drop from 2021, when it was about 19%. Okay, however, that 19% is not really normal. For Huawei. It’s not really normal for telecommunications equipment. Anyways, if you look back four or five years, their operating profits are typically eight to 10% 11%, something like that. So it’s a drop from there to about 767 percent, but nothing like 19 to six. I mean, that’s that was just sort of a bit of an aberration. Now management was asked about this, Eric was asked about Mr. Xu was asked about this during the q&a. I think it was him it could have been Sabrina and sort of gave a quick answer, but I I’m not sure it was like the complete answer was, Oh, that was about supply input costs, and then increased spending on r&d. And the r&d spending is important. I’m not sure about the input cost bit. But that’s kind of the third factoid, which is yeah, r&d spending was big. In 2022. It was increased again, from already a big number in 2021, to many was 2020 to 161 billion renminbi. So that’s about 25% of revenue. That’s a big, big number. I mean, that is typically they have been spending about 15% of revenue on r&d. And, you know, as they got larger and larger than Ericsson, in terms of their total business it used to if you look at the sort of carrier business, and you look just sort of apples to apples, Ericsson to Huawei, they’re roughly in the same ballpark. Now mean Huawei is a bit bigger. But then when you add their other businesses, their consumers overall net net, Huawei is a significantly larger company. So when they’re spending 50%, there, they’re outspending, Ericsson and Nokia dramatically, and they have for a long time, but that was at 15%. They ramped that up in 2020 2021. And they’ve ramped it up again, they’re up at 25%. So I mean, there are a handful of companies on the planet that spend this much on r&d, like this is apple and a couple other companies are up there at the 20 plus billion dollar. I’ve been joking for a while now that we’re going to hit a number here fairly soon, where Huawei is spending more on r&d, than Ericsson has revenue. And this really plays out it’s a big number. I mean, it’s, you know, given that these products become obsolete very quickly, you know, you do that for 12345 years, and suddenly you’re outspending your competitors by $100 billion dollars on telco tech. Yeah, that’s gonna matter. So anyways, that’s sort of the general picture. But overall, what you could say is, that’s back to business. As usual, they’ve restructured their supply chain, they’ve restructured their business portfolio, and their financials have pretty much stabilized, they’re hitting the pedal on r&d. And that sort of back to business as usual. That would be this. I’m more or less agree with all of that. I think that’s all consistent. Okay, so what what were my take away sort of three lessons that I don’t really hear people talking about? And this, to me was, what was important? I’ve heard that other story before, I think it’s generally true, but we saw versions of that at 2021. But there were sort of three things I was hunting for, or looking for. And number one was, what’s going on with the International carrier business. And that is really the foundation of the company that everything follows from that thus far. It could change but historically, everything has fallen from that, which is you look, they’re an international telecommunications equipment business. They’re not just China. You if you’re going to play in this game, it’s a game of global scale. You can’t just be the China company. You can’t just be the US company. You have to be one of the three to four really two to three international players to get to the scale. Hail where that’s going to work well, to get international scale and a carrier equipment business, you need, you know, the British telecoms, you need the Tesla, you need those carriers. So the number I always look for is what percentage of their revenue is coming from international versus China. And 2021, we got the number, at least I think I found the numbers, it was over 50%. I didn’t quite get the number this year. I think it’s probably about the same. So but I don’t see that dropping off. In fact, when I look at the company, what I hear from management is like, in my opinion, and this is just me reading the tea leaves, like 50% of what they’re saying is sort of speaking to the carrier customers. And you know, and sort of ensuring that like, continuity is good, we’re resilient, trust is good. Because these carriers have to make a decision, whose equipment am I going to put in? These are fairly big decisions, if you put in a 5g network could be the core could be the ancillary network, you know, whatever. Are they going to stay on the front edge? Does this company, is it stable? Is it going to be here? Do they have access to the latest technology? Are they going to get cut out? These would all be questions you might hear from a carrier. So, you know, so much of the story was three words. And we heard this words over and over and over in the presentations. One word was continuity. The other word was resilience. And then quality. When you hear these words over and over in the presentations, I mean, that to me is, you know all about this sort of international carrier business. And I’ll read you some of their slides here. I’ll put these in the show notes. But like, Mr. Xu put up, you know, here’s our five strategic priorities. First slide, he really shows. And of the five, three of them are basically what I just said. So first one is like we help industries go digital, intelligent and green to unlock new growth opportunities. That strategic initiative number one, fine. Number two, optimize business portfolio to enhance resilience. There’s one, number three strengthen synergy between chips, software, hardware, devices, networks, and cloud to hone our competitive advantage. They basically argue that the integration of all the hardware software and devices from edge to connectivity to cloud that’s their competitive edge that they can do the whole spectrum, which is I wouldn’t call it a competitive edge. But I think that’s their positioning, and they have a lot of good use cases there. Number four, succeed through quality making hallway synonymous with high quality in the ICT industry, that’s we have the highest quality stuff, it doesn’t matter what political thing is coming out of Washington, DC, we always have the highest quality stuff in ICT. And then the last one invest heavily in r&d to ensure a high level of business continuity, and enhanced business product competitiveness. So it’s all about you know, this same story of it’s always a very interesting company in that their core strategy, in my opinion, going back to 1990, has always been basically survival. And this is you know, Mr. Ren would talk about this a lot. He has speeches and articles and all that he’s written, but it was always like Huawei is not about getting rich, quick. It’s not about having a big exit through IPO. It’s not about having famous founders who sit there and you know, are famous for 20. Now, it’s about how do you create a technology company that can survive long term because very few of them do.

Jeffrey Towson 23:43

You could say Hewlett Packard is one you could say Microsoft is another very few, but most of them rise and fall. And, you know, he’s talked about this for a long, long time of how do you build an organization to last? Well, it has to do with, you’ve got to have the right business portfolio, you’ve got to be immune from certain certain external shocks. You have to have a lot of resilience and continuity in your supply chain. And this is my guess I’m making this up. But I think it might be true. You know, when they started this company a long time ago, and it was Mr. Ren and a couple of people in an office in Shenzhen. You know, one of their first things was they had a license to distribute a Japanese PBX machine. So they were basis a licensed distributor from external to internal China. And then they lost the license somehow, and basically got cut off from what may have been one of their only products at that time. So that’s not too dissimilar to what’s been happening with the supply chain out of the US in the last couple of years. And you know, he’s basically talked about developing their own PBX machine internally and very early on, they were flooding money into r&d to develop their own products. One because that’s smart and he’s an engineer by background, but two it also makes you less exposed to these sorts of supply chain risks. And you know, they moved into doing semiconductors very early on in the early 90s. To basically decrease exposure, as far as I can tell to supply chain risks for semiconductors. And that internal project eventually became high silicon. You know, 1520 years later. So you see this story all through their history of you know, we are survival first, we’ve got to make sure you know, we don’t become uncompetitive, we’ve got to keep young blood coming in, we’ve got to tell the old guard to step aside so that the young guns can aspire to rise to the top, there needs to be a clear career path. We don’t want people jumping between companies, which happens all over China tech, no, we want our people to stay for 20 years, we want their entire family’s wealth to be based on their share ownership of Huawei, and they want to grow that wealth over 20 years. And if the company grows, they get wealthy. I mean, all of this follows from this sort of survival focus of the company. So I think that’s kind of what you can see. When they talk about, I’ll put the slides in the show notes. But when they when he talked about, we are going to invest heavily in r&d. This is literally the title of the slide, I’ll put it in there, quote, invest heavily in r&d to ensure a high level of business continuity. And then there’s three examples continuity of supply, continuity of development and manufacturing, continuity of IT systems. Now, I think this is all speaking to international carriers, that it’s always going to work. You know, there’s going to be continuous supply, it’s going to work with everything, it’s going to work with all the new stuff, and so on. But I could be reading more into that then there’s their nother slide, optimize business portfolio to enhance resilience. Now, they basically this year, which we hadn’t seen before, they broke the business into five components, and they broke out cloud. I don’t think they’ve ever done that before. It used to be under enterprise. But basically five businesses, ICT infrastructure that’s carrier business, smart devices that used to be their consumer business, really same thing still. Huawei, cloud digital power and intelligent automotive solutions now the first to the business portfolio, what is the resilience of the business portfolio? Well, it’s those first two, its carrier and smart devices. That’s where most of the money is coming from. Those are the most stable businesses though the most predictable. Now consumer got hit pretty hard with the smartphone stuff. But you could argue that is the resilient stable part of their business portfolio. Then you move to the other pieces, Huawei cloud and digital power, they’re about 1/7, the size, each, much more speculative, much faster growing. But you know, less predictable. You know, it’s hard to say what halfway cloud is going to look like in three years. But we have a pretty good idea what the carrier business is going to look like. So you put them in automotive solutions, which is them providing various services to autonomous vehicles. This is very, very small, it’s kind of new. But you can see the portfolio has a mix of sort of stability and predictability and a couple of high growth bets. Perhaps I’m reading too much into that last one. They’ve got a lot of cash. The latest numbers on their cash and short term investments is 176 billion renminbi. So well over 20 25 billion US dollars, that’s a lot of cash. So they’re sitting on a lot of cash. Not that much debt. So anyways, all of that, to me, this is sort of point number one. All of that, to me, speaks to just like, it’s all about long term survival, serving the international carrier customers. Well, and reinforcing sort of continuity, resilience and quality. That to me, is what I read into that, but it’s possible. I’m sort of reading into the tea leaves here. Okay, so that’s sort of point number one. Things I think people are not really talking about that much. And I’ve been reading all the press stuff about what’s coming up. I think I may have the maybe I think I may have the biggest sort of online library about Huawei. At this point. I’ve been looking around. I think it might paint me I mean, there’s a whole ton of articles going back. For years. There’s books going back 10 years. I mean, it might be me. I’m not sure. We’ll see. Okay. That’s sort of point number one next point. And these are much shorter. That was kind of the big point. The next point, the cloud revenue, really jumped. It looked like it more than doubled in 2022. They reported cloud computing big In his head 45 billion renminbi for revenue in 2022. That, you know, I think that’s more than double. It was hard. I’m not totally sure what the number was in 2021. But I teased it out, you know, less than half of that. Okay, now there’s there’s sort of two takeaways from that, that I have number one, that sizeable revenue today, okay, it’s not 350 billion renminbi which is the carrier business. But you know, 45 to 50 billion in revenue that’s sizable, and it’s growing at over 100%. Okay, that’s compelling this, that sizable and real. And it’s showing real growth the year before it was growing at about 30%. So it looks like accelerate, it’s not totally clear what those contracts are, you don’t get a lot of visibility into that. And you also the margins, not clear, it’s hard to know what’s in those contracts as an outsider. But my my take away from that is like this, is there one business that has the potential to 10x in the next five years. And it wouldn’t take that much. If you look at say Alibaba cloud Alibaba cloud is kind of number one for cloud market share in China, Huawei, Tencent cloud, they’re kind of two or three. But Alibaba is close to about 11 billion US dollars. So more like 80 billion renminbi so about double what we see for Huawei. Okay, if they can just match Alibaba numbers, that’s another 100%. Increase. That’s significant. And then if you look at say, AWS and Azure, which is, you know, US International, really not China. Okay, that market is quite different. I don’t think you can, these are apples to oranges comparison. But if you look at AWS is just sort of a general comparable. If Huawei cloud was to one day reach the size of AWS today, that would put it at about 350 billion revenue, 350 billion renminbi it would make it larger than their cloud business. So there is the potential there for sizeable growth. It’s not like we’re making this up, we can see the spending in other companies right now. So there’s the potential for a 10x growth in their cloud business. And it’s already sizable, and it’s already growing pretty fast. Okay, that’s compelling. I think it’s a bit vague on what they’re they’re planning to do in that space? Are they going to stay purely infrastructure, infrastructure as a service Compute Cloud? Or are they going to move to more domain specific applications? And I suspect their goal is to not do that, because they like to be general infrastructure and not, you know, banking specific AI programs, though, they like to say, general, I’m not sure that’s the right move. We’ll see what they do. Okay, so that’s point number two. Point number three, which is just a quick point.

Jeffrey Towson 33:05

The consumer business, which was growing like gangbusters before the sort of US China situation took off. I mean, it was really growing dramatically 2015 to about 2019. They were making smartphones, they were making ancillary devices, I think their smartphones were better handset wise than any others, anywhere, fantastic devices, and then they got hit. And unfortunately, the smartphones got hit hardest. If you can’t get high end semiconductors, it’s really hard to put leading edge, you know, capabilities in a low power chip. And that’s really the frontier the five nanometer and such, that got hit the hardest. And it got hit internationally. And they took a pretty major hit 2020 2021, but basically, the consumer in 2021, the consumer business basically fell by half in terms of revenue, it really got hit, it fell to about 243 billion renminbi in 2021. So I mean, that’s, that was pretty brutal. But 2022, the revenue was 214. That’s kind of what surprised me is it kind of stabilized? I thought it was going to go down because of that. Look, the smartphones. There’s no obvious solution to the smartphone problem getting the high end semiconductor the chipsets getting access to an operating system. They don’t have that they have to there’s no obvious solution to that, like there was for carrier where they could restructure their components and build in redundancy in their supply chain. There isn’t an obvious solution there. And yet, the revenue kind of stabilized. I thought that was kind of fascinating. And my assumption is they’re consumer Business Strategy has always been sort of one plus eight plus n. We, you know, the one is the smartphone, the eight is ancillary devices that tied to your smartphone, like, let’s say VR glasses, earbuds, smart home, probably car, those sort of ancillary devices support the one and then plus n would be IoT devices in everything that was and I think that’s about right. My guess is yeah, okay, the smartphones have been hit pretty good, but they’re really shifting the revenue into the eight. They’re making earbuds which are great. By the way, I have Huawei, your buds, they’re fantastic. They’re making smart home devices and all that. So I think that revenue is compensated for the smartphone hit, but that’s a guess I can’t see the breakdown. And it was said that that was kind of a surprise that the consumer business revenue appears to have stabilized. Now, if that’s true, that’s going to keep them much larger than Ericsson and Nokia, they’re going to keep outspending them dramatically in r&d. And that’s going to matter. Anyways, those are kind of my three takeaways from the event. I think that’s enough of me talking about that. No real lessons for today. That’s just sort of how I’ve been thinking about it really cool company. Anyways, what else? Yeah, I had a pretty good time. And they had they had a little reception afterwards, which was fantastic. I mean, really great event. Ballet dancers, singers. Yeah, they really put on pretty good event and then and then I bounced back home Saturday, pretty soon after I’m heading back into China in about another week. Actually, I’m going twice more in the next couple of weeks. So yeah, back to sort of life as usual flying in and out of China and you know, lots of time and immigration we’ll see if I get through without any issues this time. I don’t think it was actually an issued immigration I think it was just one dude. Like because he didn’t ask me anything about my passport or visa. I didn’t really ask about any of that. He was just asking about the beard. So we’ll see if if anything happens this time around. Okay, and that’s it for me other any other stuff. I can recommend another terrible TV show. I don’t know why I’m watching terrible Netflix show I told you about the the too hot to handle, which is awful one then I was watching a show called sexy beasts. And this is much worse, like much worse. This is another like dating show. But they put on these masks. Like these really elaborate masks and people have to get to know each other without seeing each other and then they reveal they take off the mask. And yeah, it’s really terrible. But I’ve watched like five episodes. I don’t know why I’m doing this, but I’m kind of in a little thing. Anyways, that’s it. Yeah, I would say that’s not a recommendation. Don’t do it. But too hot to handle. Yeah. Okay, try it, you might get a kick out of the first couple of sets. Anyways, that is it for me. I hope everyone is doing well and I will talk to you next week. Bye bye. Bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.