This week’s podcast is a rant about the common “China is going to collapse” narrative. Most recently made by Peter Zeihan on Joe Rogan.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the China Tech Tour.

Peter’s interview with Joe on China is here.

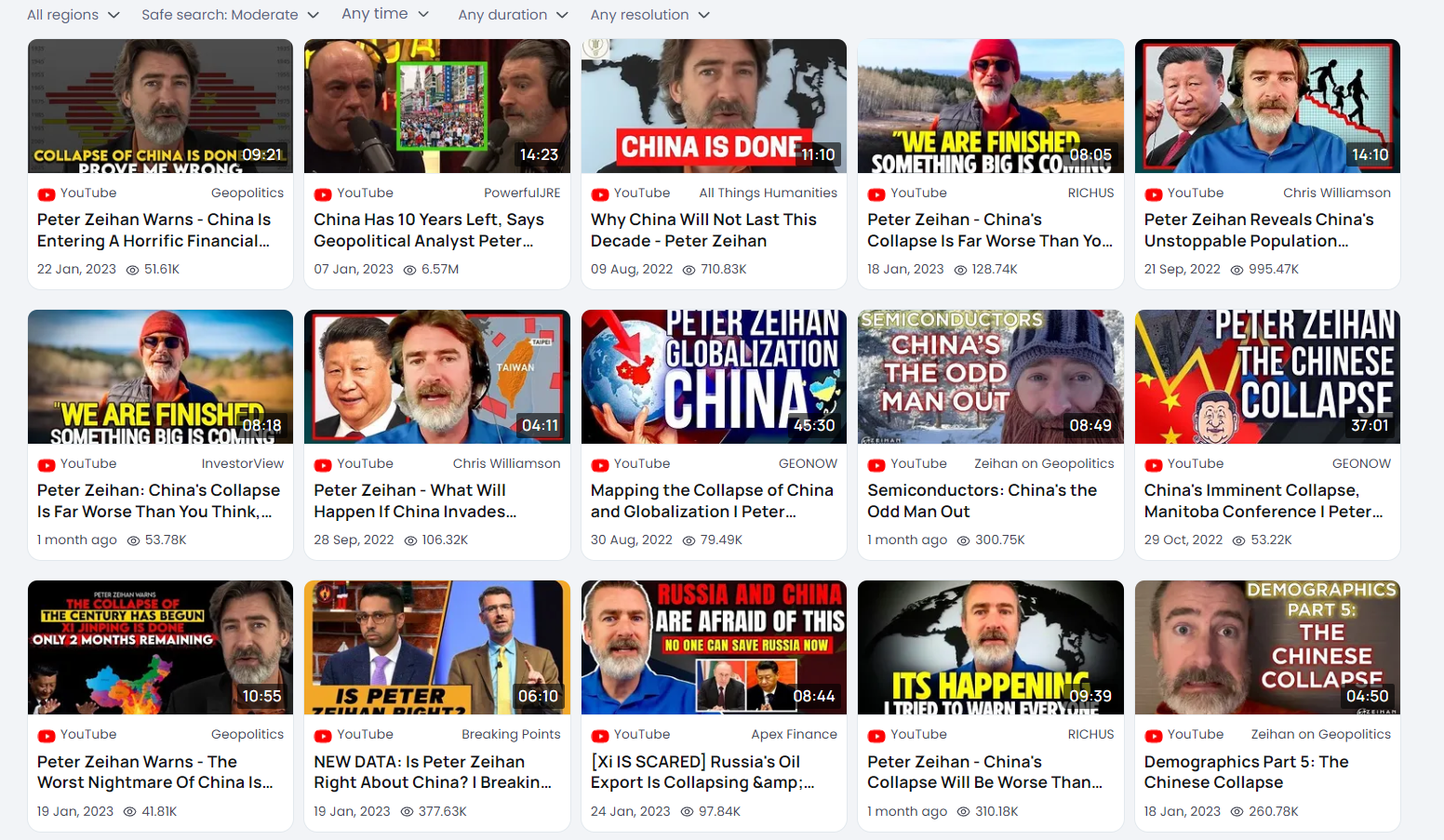

Here are some recent thumbnails on this topic.

Here is the Bank of Japan study.

Here are the two books mentioned:

- The One Hour China Consumer Book: Five Short Stories That Explain the Brutal Fight for One Billion Consumers

- The One Hour China Book: All of China Business Explained in Six Short Stories

———

Related podcasts and articles are:

From the Concept Library, concepts for this article are:

- n/a

From the Company Library, companies for this article are:

- n/a

——–Transcription Below

Episode 155 – China.1.transcribe

Tue, May 16, 2023 2:34PM • 43:10

SUMMARY KEYWORDS

china, talk, people, collapse, gdp, number, zion, companies, chinese, economy, argument, south korea, pretty, country, japan, peter, macro, productivity, world, big

SPEAKERS

Jeffrey Towson

Jeffrey Towson 00:00

Welcome, welcome everybody. My name is Jeff Towson, and this is the tech strategy podcast where we detail the best digital businesses of the US, China and Asia. And the topic for today, Peter Zion, and why the China will collapse narrative is so stupid. So I guess I’m a bit off topic on this one, let’s say half off topic. And like, this is a rant. There’s no way around it. This is a rant. I’ve been sort of following this subject for quite a while, and it’s gotten under my skin. So I thought I would just sort of rant a bit about it. But basically, Peter Zion who actually seems I don’t know him, he seems like a really cool guy, actually, pretty, pretty big YouTuber. He does a company called Zion on geopolitics, basically talks about geopolitics he used to be at strat for which is a Texas based geopolitics firm, for a long time. And it was he was on Joe Rogan a week or two ago, a couple weeks ago, talking about a lot of things. But he does, you know, obviously talk about China geopolitics, and he does get into the economics a bit he likes to talk about population growth and replacement rates and things like that. And anyways, he had a very strong opinion that basically was chatline is gonna collapse. And I mean, it’s pretty strong opinion, no way around it. Here’s an exact quote, quote, they are going away, and they are going away this decade for certain. That’s about China, basically. Now that’s economically and politically in other ways. But I mean, pretty strong language. And you know, this has been going around for a while, a good year or so. And if you actually go on, let’s say, YouTube, and you search for like China collapse, or China’s AI, and you will, I’m looking at it right now you get, it looks like 15 to 20 of the first videos shown in, you know, in this sort of list. I mean, they’re just all over the map. It is like, here’s the first one, Peter Zion, China’s changing, this is why China will never overtake the US. Next Video. China’s collapse is far worse than you think. Number three us well, that’s that one’s Alright. The next one, rest in peace, China, China’s population Christ, the complete breakdown of China will shock the entire world. Peter Zion says China’s frightened to its core, China’s population crisis. I mean, it goes on and on. And most of these are not him. Most of them. These are him, people taking his talks, turning them into videos, and then putting provocative thumbnails on him. But it’s a thing, the whole China will collapse thing. It’s it’s kind of a narrative that’s being aggressively pushed. So let me read you another one. This is from Peter. Quote, I would say we expect the economic of collapse of China in this coming decade, we’ve been talking for a while about how the economic system there is remarkably unstable. And we think that they’re going to reach a break point, as all of the internal inconsistencies come to light and shatter. By the end of the decade, it’ll be pretty obvious to everybody that the shining miracles over. Oops, hang on, I made a mistake. That is Peter Zion. But that was not from Joe Rogan. That was Peter Zion in 2010. Back when he was Vice President of Strategic Intelligence at Stratford that was published in Business Insider. So he’s been saying that sort of storyline for a good 13 years now. Here’s one more China will suffer a meltdown like Japan and East and Southeast Asia before the staggering proportion of bad debt, even in the staggering proportion of bad debt. Enormous even in relation to official dollar reserves represents a defining crisis for China. Oh, wait, I made another mistake. That was not 2010. That was 2005. Now that was strapped, for which I assume it’s Peter, because he was sort of leading that then. But it could be it was the same sort of story coming from them. So this narrative this China will collapse narrative has been going on for a long time. I think it is a fairly profitable narrative to push it get you speaking engagements, it gets you attention, it gets you views on YouTube, which is why everybody is taking those clips and pushing them doesn’t mean they think it’s wrong, but there’s clearly some self interest there and this sort of provocative title. And if you actually go online in the last year, I mean, it is just one after the next here’s CNN 2022. China’s economy is in deep trouble. It’s over China’s entire economy is about to collapse. That was Graham Stefan, who is kind of a YouTuber that was in 2022. And then of course, the godfather of this, this narrative is arguably Gordon Chang, who’s a frequent commentator, very political commentator, as opposed to economics. He wrote the book, The Coming Collapse of China, which was published in 2001. So now that’s a mix of people with this narrative. Some of them are just YouTubers and whatever, selling books and getting speaking engagements, good intention, but others are serious thinkers. There are there are some I don’t want to downplay all of it. Investor, Kyle bass, very, you know, successful investor, he’s been very bearish on this. And he’s not just talking, he made major investments based on this. So there’s a spectrum there. But I didn’t want to engage in all that. But my point is that there’s this widespread narrative, for a couple of reasons. But I wanted to talk actually, about the Zion argument, because this is basically a consulting firm, so they have clients, and they have, you know, they have data behind what they’re saying, I don’t agree with any of the conclusions more or less more than any of them 70%. So I thought I would sort of go through their main arguments, in my opinion, which is my paraphrasing, and then tell you why I think it’s completely and totally wrong. Okay, so this is macro analysis. This is my I call it macro hand waving. But this is sort of the argument that Peter made on Joe Rogan. And I’ll put the link so you can watch this part of the interview, it’s in the show notes. Basically, he talks a lot about population rates, how many people in their 20s, how many people in their 30s 40s 50s retirement. And as countries get older, you know, the, the demographic shifts to more older folks. And, you know, this is everyone’s getting older, all the countries are getting older. And there’s that has some major impacts on various types of parts of the economy. And his argument is one Chinese getting older. But it’s also getting older, a lot faster than we used to think it was going to be. That, you know, there’s been probably an over counting of, let’s say, 50 100 million people that weren’t there, and those who are mostly young people. So basically, there’s a lot fewer 20 to 30 year olds than we thought. And those are the people who do consumption, who drives spending, people in their 40s, and 50s, tend to save people beyond that tend to then start taking their savings out. So you need you sort of need all of those things happening at the same time. But they’ve basically got an inverted model, which means a lot of people are moving into retirement. That’s probably I think, one of his main arguments is population. And we’re seeing that in other countries as well, like Japan is already there. Us is pretty good shape, actually. But a lot of countries, but China’s faster than most. And that’s going to have an impact on their growth on their labor costs and some other things. So some of these things are about demographic collapse. You’ll hear that phrase, okay. The other argument he tends to make Well, I’m paraphrasing here, so you should really listen to it. I don’t want to speak for him too much. But he starts to draw conclusions that get him to the conclusion that tuck China has 10 years left. First of all, the demographics have a big impact on labor costs, you have fewer young people labor costs increase, and he says China’s labor costs have increased by a factor of 14 since 2000. But productivity gains have only increased by a factor of three or four. So the Chinese labor is now more expensive than let’s say Mexico, which is the, the example he gives. And I’ll sort of say why I don’t think these things are that big a deal later. But let me go through the argument. Then he goes into some other random factors, which I think are incorrect. This is a quote, quote, education focuses on memorization versus skills, unquote. That is absolutely not true. I am a professor in China. They are some of the smartest, most capable most ambitious students I’ve ever seen. You give me 10 college students. Now let’s say you give me 100 Random college students from China, you put them up against 100 Random college students in the US, they will run circles around them. Now at the top tier, things in the US are pretty impressive, but in the average middle of the bell curve, Chinese students are going to win four times out of five.

Jeffrey Towson 09:52

So this whole Oh China just memorizes they don’t just nonsense. That was a trope from 1994. That seems to stuck. around another quote, This is Peter, they quote, they haven’t advanced technologically in the last 15 years. That’s insane. That’s absolutely insane. Go to a factory, go to Alibaba go to a bank, there’s tech everywhere. This arguably the strongest business models are coming out of China. Now, according to Charlie Munger, Alibaba is unbelievable. Baidu is fantastic. bytedance Tick Tock is running circles around Facebook, you put 10 cent up against anybody in Silicon Valley. There’s some exceptions, Amazon’s pretty awesome Microsoft Word, but the average Silicon Valley company going up against Tencent will get their head handed to them. I mean, Elon Musk just hired his new CEO for Tesla, and he pulled this his guy from China. So this idea, they haven’t advanced that that’s, it’s it’s blatantly wrong. Then he gets into a little bit more political stuff, they’ve consolidated into more of a cult of personality, that power has become centralized, with President Xi in a way that it wasn’t before. He argues that he’s not getting information because people are afraid to give him information. I see very little evidence, and I’ll give you my take on how you take apart the state in China as it impacts Business and Economics. I think that’s mostly nonsense. If nothing else, it’s it doesn’t pass the laugh test. It’s a massive country. It’s absolutely huge. You’re talking about a billion plus people, industries, millions of companies, the vast majority of all decisions, all governance, all policy is being done at lower levels. It has to be, it absolutely has to be. And I go through, you know, the regulations that impact my area, which are technology, which they’ve done some fairly major tech regulations in the last two years. I’ve gone through them in detail. They’re the smartest, most well thought out technology regulations I’ve seen anywhere in the world, by a long ways. Much better than what we’ve seen in India, dramatically better than California, the US. Europe’s a bit of a mix, Australia’s pretty ridiculous. Anyways, there’s all these sort of these are sort of the general arguments he makes, which is going to be a paraphrase of his overall. So it’s probably not all his thing. But based on this sort of thinking, which I consider sort of macro hand-waving. He concludes Yeah, quote, China, they are going away, they are going away this decade for certain unquote. Yeah, I think it’s ridiculous. Okay, I mean, you can you can consider this macro hand-waving versus micro analysis in reality, because that’s what I do. I spend my my years taking apart companies and seeing what’s happening on the ground.

Jeffrey Towson 13:16

Okay, so that’s sort of the first pass and I’ll put a picture of all the thumbnails in the show notes. So you can take a look, and I’ll put a link to his stuff. And you should listen to him. He’s actually pretty. I mean, he seems like a really cool dude. He’s very charismatic. He’s well spoken, very articulate. Yeah, he’s probably a lot of fun to hang out with, too. But yeah, I totally, completely disagree with the argument. And okay, let me get into some how I view things and then you can sort of decide what you think. A couple of stories. So let’s see 2008. Back in 2008, there was the big Beijing Olympics, which was really kind of a Coming Out Day for China. This was when most but prior to that most people weren’t really paying attention to China Business people knew. But politics not at all. And then your average person in the US Europe, Latin America really didn’t know much about China was out there wasn’t on the newspaper. I mean, you wouldn’t see it. Then then 2008 The sort of Olympic opening games happen. They had this great, tremendous opening ceremony and that was kind of the day when most people started paying attention. South Park did an episode about China and all that. And I was at the opening ceremonies for the the Olympics. I was. I had been invited by the Kwok family which was they were massive real estate family in Hong Kong back then. Now things have changed. Walter and Raymond Kwok and others I was when I was in their family box, they had seats at the bird’s nest in Beijing. And you know, it was pretty amazing with all the drummers and the Fireworks were unbelievable. And it was really spectacular show. And then off to, you know, my left sort of catty corner to where I was, you could see the President Vladimir Putin was there at the time, which was interesting to see him. And it was it was really kind of a fantastic experience. And that’s when people really started to pay attention to China. Besides those of us, you know, sort of old hands, which they, they call us the Old China hands now they call us the dinosaurs. But that was kind of there. And then, you know, I’ve told this story in my book, like, the next two days later, I was hanging out in Beijing and just a cafe. And in watch Jimmy Page, who would you know, the, the rocker guitarist from England, and he had performed at the games at the opening ceremonies, when England did their thing. He was up there on a bus, playing guitar. And I was I ended up chatting with him. And it was, it was one of the stupider experiences of my life. Because I wasn’t sure it will feel what’s him. And then he kind of said, Hey, and I said, Hey, how you doing nice to have. And then it was pretty obvious. I knew who he was, but I pretended I didn’t know. And he obviously knew I then knew, but I didn’t break character, which was really stupid. So we had this ridiculous exchange where he’s like, What are you doing here? And I said, Well, I work here, and I’m working on projects, and blah, blah, blah. And I said, Well, what do you what are you doing here? And he kind of looked at me, he knew I kind of figured it out at that point. And he said, Oh, I’m here for the Olympics. And he was with his buddy. And I said, Oh, what are you doing with the Olympics? Which was ridiculous. It’s one of these ones where like, You got to come clean and say, Okay, I was one I knew who you were. And two, I told a little lie. And instead of just coming clean, I got to stick with the lie with it was ridiculous right? Now. So what are you doing with the Olympic as he goes, Oh, I’m doing synchronized swimming. Which is pretty funny joke. Anyways, chatted a bit and then, you know, saw him on the street a little later. He’s actually a pretty nice guy. That was 2008. You fast forward. 2010 2011. We used to talk a lot about in China. The big question was, why don’t Chinese consumers spend money? That was the big question. Like we know, they have the income. We know they have the assets most Chinese own their own home, but they do not spend. That was the big thing. And then 2010 2011 That finally started to change and they started spending. And really what we saw over the next decade, was Chinese consumers becoming a major force in one industry after the next. They started buying cars for the first time in numbers. Oh, and they became the largest car market in the world. They started gambling for the first time going to Macau, Macau is gaming revenues four to five times Vegas in a couple of years. They start traveling for the first time, okay, now they’re flooding. The biggest tour group in the world, they’re flooding the Louvre in Paris, you’re seeing him everywhere, and they spend more. It was just one story after that next light that as they sort of became the biggest ecommerce sector, the biggest online payment sector, the biggest buyer of smartphones, but but that was really the next 10 years. And a lot of that was enabled by the fact that they all had smartphones. And that enabled all of that around 2011 to 2013. It used to be Samsung. When I when I was there, it was the big smartphone that everyone wanted was Samsung. And then 80% of all smartphones sold back then were Western or Japanese, but they weren’t Chinese. And then the iPhone entered a year or two later, everyone crazy for that. Xiaomi then copied the iPhone a couple of years after that. But you fast forward seven years 80 to 90% of all the phones sold in China are now Chinese. Samsung has now basically left the only one left is really apple at this point. And now pretty much anywhere you go in the world India, Latin America, everyone, with the exception like the US pretty much everywhere you go in the world, everyone’s got Chinese smartphones now. And then maybe Samsung and maybe apple and that’s pretty much it but Nokia Motorola Nope. And it was that’s been kind of the tenure. We’ll call it consumer boom. Now that has slowed, obviously in the GDP growth, which was you know, to 9% 10% 12% back in 2008, nine and 10 Okay, now it’s let’s say three to 5%. Which is reasonable because the economy is absolutely huge now. So you’re not going to grow that fast. But when you look sector by sector, it actually, you know, jumps around pretty good SUVs, you know, 15 to 20%, high end smartphones or high beer, basic beer, it’s probably flat growth or shrinking healthcare spending going on. So you have to kind of take it apart sector by sector, but generally speaking at the overall GDP, you know, the growth is way down. And that brings us to today, nominal GDP of China is about $18 trillion. That’s massive, the US 25. I mean, it’s, it’s not as big as the US. But when you look at sort of global GDP, the US comes in around 25%, China comes in around 19%. And then there’s nothing next, right? At an individual country, the next country on the list, if you go country by country, is Japan at five. So this idea that like at first glance, it’s like, oh, China’s going to collapse. It’s like, really the world’s second largest economy by a mile. All that $18 trillion, is just what’s going to go? No, it doesn’t pass the laugh test. Now, I left out the EU. If you you know, if you don’t do a country by country, and your roll up the EU is when economy, which is what you should do, that’s about 16 to 17 trillion as well. So it’s really US, China, EU, that’s the world economy, you know, and then everything else is much smaller. So you go further down the list, you’re going to hit say South Korea, that’s most everything else after that is 2 trillion, 3 trillion, 1 trillion South Korea 1.7. So that’s sort of the first way to look at it, then you start looking at GDP per capita. And this is where China in the US diverge dramatically, us, you know, $70,000, nominal GDP per capita 2022. You know, China’s a fifth of that, a sixth of that you have to look at at Shanghai, Beijing versus other places. But, you know, average GDP per capita of China is about 12 $13,000 per year. I mean, it is. So it’s this weird scenario. Now, if you look at the EU, it’s about 37,000. So China has this weird scenario where it is a massive economy. But the GDP per capita is still quite low. So that’s what kind of makes this all really interesting. Okay, that’s a little bit of backstory. Let me jump into what I think matters here. And the way to think about it. All right. Now, the way I think about this is I look at six megatrends, which is a silly word mega trend, but it’s pretty accurate. The long term trends that sort of drive the development of the economy, and that show up in the business numbers, like, it’s easy to talk about trends and wave your hands, I like to see it in the income statements of businesses. That’s real, that sort of micro level analysis that you then bubble up. Okay. Now, I wrote a couple books on that called the one hour China book co wrote them, and I’ll talk about those briefly at the end. But what are the external factors that could upset that? Which is I think, with these China collapse, people are talking about what are the external factors? And I think there’s three that matter. Keep in mind, I am not an economist. So this is my own, you know, thing. Okay, the first real external issue that matters is the demographics.

Jeffrey Towson 23:18

But people aren’t really thinking that the population is going to shrink dramatically. It’s not like, half the, you know, half the population is going to go, it’s just you’re gonna see sort of a shrinking of the labor force. Okay, fine. But it’s, it’s 1% 2%, that sort of thing, right? What really matters within the demographics is how these changing demographics, how it impacts the long term growth projections. Right. It’s not that China isn’t 1.3 billion people and $18 trillion. It’s what is it going to be in 2035. And what people have projected it’s going to be is being reassessed based on In fact, the changing demographic situation? So it’s the long term growth question. That is important. Now, to some extent, that matters a lot. And to another extent it doesn’t, because it’s still an $18 trillion a year economy. You think businesses are going to leave that there aren’t that many economies in the world and this is number two. So it’s not going anywhere. It’s just that the growth projected longer term growth is slowing. But it’s still number two, and you’ve got tremendous companies and all of that. And you can see the strong companies all over that. You can see everyone in the US is on tick tock. Everyone’s in Brazil is on Sheehan. If you go on Amazon’s marketplace, 40% of those merchants are now Chinese. Pretty much everyone listening to this either has an Apple phone in their pocket or a Chinese phone, your refrigerator that’s from China probably. I mean, you can see it apps salutely everywhere, which was not the case 10 years ago, but there is this question of the long term growth projections. So I’ve been kind of reading about this because it’s more of an economics thing than I usually. It’s obviously I’m not, I’m not a macro economist. But the analogy I like, which was from a bank of Japan study, which Jonathan, what’s all sent to me? And I’ll put the link in the show notes. What basis is, how does China’s growth GDP, compare with the other Asian giants, where we’ve seen them take the same path, which are Japan, South Korea, Singapore, and then Taiwan, which depending how you define it, you know, that’s a whole political thing. But you can look at those at let’s say, economies, as opposed to whatever, we can look at their trajectory they took, and then track China against that. And pretty much if you look at their GDP growth, and you look at China’s GDP growth over the last couple of decades, it followed the same path, it grew at around the same pace, the growth slowed at a certain pace, it looks very similar. Now the difference is, is now that we’re at this point, in the process of sort of GDP growth, China’s GDP per capita is much lower than those countries were at the same stage. That’s kind of the big difference. The GDP per capita of China versus is about 20% of the US something like that. And that’s not terribly surprising. Because I mean, it is a fundamentally different animal at the enemy. South Korea is a small country, Japan is big, but it ain’t China big. So it is a little bit of its own animal. So then the question is, okay, is the economy going to double by 2035? Which is what people have been talking about a lot? Well, that depends on a couple of things. It depends on the productivity growth, and it depends on the population. So is it going to play? Is it going to follow the track of these other countries? Or is it going to be significantly less? And the reason people are revising their projections down is because three factors look like it’s sort of slowing that. Number one is the aging population. Okay, that’s real. So it’s going to impact that longer term growth. Number two, all of these countries, were manufacturing led growth for a long time. Well, it’s hard to grow dramatically, when you are already 25% of the world’s manufacturing. You know, are we really going to double the size of economy with a lot of manufacturing growth when you’re already 25%, Japan, South Korea, Singapore, they were not 25% of the world’s manufacturing. So that growth aspect is a lot harder. The other issue is probably agriculture. And this idea of food, food security. China does tend to keep more people doing agriculture, because they’re worried about food security. And when you keep people doing agriculture, as opposed to doing services, and manufacturing, the productivity overall is much lower, because agriculture is a very low productivity activity. So they’re sort of keeping, you know, 27% of their labor force in agriculture, when we would expect to see that number drop, they may keep them there. So all of those things, and this is not my thinking, this is sort of Bank of Japan. All of that is like, Okay, that looks like it is going to slow their long term growth trajectory. Okay, so is it going to double by 2035? unclear, but this is, you know, an impediment to that. And I think that’s a real issue. And Peter Zion talked about this in sort of a different way, but he was pointing to this. So that’s real. Number two issue that I think is real. As you get an aging population, that does raise the question of are you going to have some sufficient capital accumulation? People, you know, they work they save, and then they get to a certain age, they retire, but they’ve got enough capital accumulated from themselves. And the whole country has enough of capital accumulated for reinvestment and all those and this is why people ask the question, Is China going to get old before it gets rich? Well, look, you’re gonna get to this aging population before you’ve accumulated enough capital. Maybe, maybe I’m not actually worried about that one. I think China is very, very good at raising capital. I think they’re very good at deploying people’s savings, which they’ve been doing forever if you put your money in a Chinese bank. That is pretty much deployed in sort of economic and strategic and political ways. By ICBC, Bank of China, that sort of thing. And then the third external issue would be sort of real estate bubbles, or recessions. That’s pretty standard in China, that there’s always this was a big deal with Evergrande earlier this year that oh my god, this company is gonna go bankrupt, this real estate company, it’s going to have knock on effects into the banks, and we could have a major recession. Is this going to be a Japan style last decade? And no, it’s not. You can look at the reserves, you can look at the cash on hand. And real estate booms and busts happen every single year in China, they just happen at the regional level, it’s very normal. China deals with real estate booms and busts the same way Hong Kong deals with hurricanes, they’re just built for it, they know what’s going to happen, everything’s fine. Okay, so that’s kind of the macro story that I pay attention to. And then when you look at sort of what the government is doing, whether they’re going to double their GDP by 2035, well, you can see them starting to move more people out of agriculture into other industries, which helps your productivity rate overall, they’re pushing urbanization, you still got a whole bunch of people, that you can move into the cities. And then sort of the big lever, which is now now we’re in my area, which is innovation. People point to the fact that China has low labor productivity, which is true, overall, but if you look sector by sector, you look at manufacturing, you look at healthcare, you look at Tech, you they have some very impressive productivity, you gotta look at the industry by industry and region by region, you can’t go by the overall number. And that general low productivity apart from being a problem, that’s your opportunity. That means you have a large amount of increase you can do because you if you can move halfway from where you are to South Korea level of productivity, that’s a big boost to the GDP. So that’s kind of a counter argument. So I think that’s actually probably the biggest lever they have is innovation and productivity improvements. Okay. Let me now get out of macro stuff, because it’s not really my thing. But I have been looking at China’s macro stuff for a long time. Let me get more into my area, which is alright, what are the trends that matter? Such that these three external potential shocks factors, I’m not worried about them. Okay, now, my Northstar, the main trend line I always look at, which is one of my other six mega trends is basically domestic consumption. And Chinese consumers, specifically, middle class families, middle class families are the great engine of China that are the great engine of Asia. If you’re not betting on this as a trend, I don’t know what you can bet on in life.

Jeffrey Towson 33:03

You have really strong extended families who plan ahead, who spend tremendous amounts of money on their children’s education who pass on wealth, who helped your average 22 year old Chinese college student by the room with their first apartment. Homeownership rates in China are, I believe, still the highest in the world. And that’s almost always the parents or the grandparents giving money for the down payments that the child can buy their first home. They’re very smart, money wise, and the consumption keeps going up and up and up. And it’s fantastic. So you watch the disposable income number and you look at the number of middle class families, both those numbers are going up and up. That’s sort of engine number one. If I see that start to move that would worry me. I don’t see it moving. It’s a rock solid trend. Number two, brain power. This is the one people don’t talk about. Especially economist. There is a tremendous amount of brain power engineers, scientists, artists, economist by all biologists, you know, typically nine to 10 million graduate, I mean, these millions of graduates every single year. China now has more master’s students or nor master’s degrees and bachelor’s degrees than the US. If you look at r&d investment, I mean, they have had their pedal to the floor on r&d investment for 10 years. r&d Investing overall in China and grows by about 10% per year. Their ratio of r&d investment to GDP is remarkably high. You can kind of this is kind of I think it’s easier if you’re a professor or if you hang out at companies in China. because you see this immediately, you just meet, you know, one PhD after the next you just meet one bachelor student and by the 1000s, when you hang out at Alibaba, and there’s just 1000s of people walking around and like, look at all these, it’s really stunning how much it is an Elon Musk talked about this when he opened his his factory in Shanghai. And he kind of they opened it. And he went spent some time there, one of the first things he said was, you know, I’ve never seen such vigor at scale, that there is just tremendous brain power everywhere. And I’ve kind of already said, like, the students I deal with are unbelievably good, incredibly driven, they’re, like, so ambitious, it’s scary, I’m glad I’m not competing with them. So you put that sort of brain power effect up against the productivity opportunity. You know, and it’s really, it’s really easy to be optimistic about China, when you spend time on the ground talking with people as opposed to looking at macro stuff. Okay, so third factor will be digital China, digital tools, digital technologies, all of this are a great shortcut to increasing productivity, you give your accurate average factory worker, an iPad, they start to become much more effective, although they would do something other than iPad. So you know, the fact that you sort of have all the brain power, you have this domestic market, and then you have all these tech tools, like, it’s really easy to be optimistic about the productivity numbers. Okay, and last one is, there’s just a ton of capital, there’s money everywhere in China. And the system by which it has been deployed over the last 20 years has been very inefficient. A lot of state banks know that’s gonna get a lot better, you’re gonna see a much more sophisticated process for capital allocation. That’ll help things as well. Anyways, I did ask Jonathan, who’s Jonathan has forgotten more about China than I ever have ever known. This is Jonathan Watson, who is a co author of one hour China book. So I sent him a little note and asked him like, you know, what metrics would you look at? Like what what numbers would jump out to you if you wanted to sort of project the Chinese economy going forward, and he basically sent quality metrics. And by the way, they’re all improving life expectancy, improving industrial profit margins, improving r&d output per employee, improving household income growth, improving, sort of all the main ones are improving that you’d want to see. And now, contrast that with the US. I’m an American, life expectancy is decreasing. It’s not increasing, it’s decreased for the last several years. Look at the state of the cities, look at the state of San Francisco, look at the state of Los Angeles. I mean, these are, it’s hard to say, Oh, these cities are getting better and better. I mean, some of them are the malls are getting nicer, and the homes are getting nice, but the cities are pretty, I wouldn’t say in decline, but it’s a real mixed picture. So you start to look at these sort of quality metrics. And they’re all moving in the right direction. And they’re all going up. So anyway, that’s kind of my take. That was a little bit how he gave me some feedback. I think that’s pretty much what I wanted to talk about last point. Because I know I’ve been sort of going all over the map here. The other thing people don’t talk about is the entrepreneurial culture. I mean, I spend a lot of time in Mexico, I like Mexico, Mexico City is awesome. Give some talks in Monterrey. Guadalajara is real fun. If you just go by the numbers of population and overall productivity, you’re going to miss a lot of the cultural differences. Singapore has a very effective culture. That’s why they rocketed up. And then there’s also leadership policies. But I mean, Singapore did not become Singapore, because of its population demographics. It’s a tiny little place, has a lot to do with culture, family, and smart leadership and the government things like that. And then good companies as well. You can say the same thing about Israel, you could say the same thing about South Korea, you could say the same thing about Dubai. So when I kind of look forward, I pay a lot of attention to this. And China benefits from that tremendously. One, it’s not small like the others, but it has this really strong entrepreneurial culture. You’ve got strong middle class, two parent families. Everyone who thinks education is the single most important thing you can do. And kind of have an enormous amount of ambition. In Is it a surprise when you when you live Look at somewhere like UC Berkeley in the United States, and 40% of the student body is from China and Asia in some form, usually, recent immigrants coming over or Asian American families, I mean, you can see it everywhere. Right? It’s hard to to put a number on that. But if you hang out somewhere long enough, you really dig in to get a sense of it, then you can say the same thing about companies. You can say the same thing about cities as opposed to countries. But that’s important. So that’s probably in the top three reasons why I’m sort of bullish on all this. Okay, I think that’s pretty much what I wanted to talk about. We did write a book several years ago called The One hour China consumer book. And what we did in that is we took apart the role of the state, because people can always companies in China, but then they never know how to think about the role of the state, which is the government, it’s the party, it’s a lot of things. And we put together some frameworks for that. And I think that’s a lot of the other problem. When people talk about this China collapse argument, they sort of point to demographics, or they put they point to the role of the state. And I don’t think they really understand how things work. If you’re, if you’re opening restaurants in China, you don’t think about what’s happening in Beijing very much doesn’t really matter, you open the restaurants and the state has no interest in restaurants really beyond typical health and safety type stuff. And then other sectors that are very involved in sometimes that can be a real break on development, like public hospitals, you have to move very slowly. And in other times, it can be the mother of all catalysts. If you’re in wind or solar, in the last 20 years, the government has been your greatest friend in China. So you really have to take it apart at a more granular level to understand what’s going to likely happen. So I think people get that wrong. Okay, I’ll put a link into that. But I think that’s enough of me sort of going into high level stuff, which I don’t really like to do that much. It’s not really my thing. But anyways, there’s kind of all these China collapse, things were really sort of annoying me. I thought I would do a little bit. Okay, I think that’s enough for this. I will go back to more micro analysis in the next one. And I think the next one we’ll talk about is probably ding dong, which is it’s a really interesting B to C, fresh grocery delivery company in China. That’s a lot like Zed delivery in Brazil. And it’s actually a very good business model for a lot of developing economies like Southeast Asia area, Latin America, probably not the US.

Jeffrey Towson 42:45

Anyways, I wrote about them about a year ago, and I wasn’t terribly bullish on them, because I didn’t see how they were going to make money. Well, they just announced their fourth quarter 2022 They reached operating profitability. And that’s a bit of a surprise. So I’m gonna go into that and kind of take figure out why that happened. And that is it for me this week. I hope everyone is doing well and I’ll talk to you next week. Bye. Bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.