This week’s podcast is newly public GoTo, which is an interesting business model combining a platform for products (Tokopedia) with one for services (Gojek).

You can listen to this podcast here or at iTunes and Google Podcasts.

——

Related articles:

- Will Southeast Asian Grab Become Meituan or Didi? (Asia Tech Strategy – Podcast 121)

- Grab’s Big Strategy and Cash Flow Question (1 of 3) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Complementary Platforms

- Digital-Physical Hybrids

- Barriers to Entry

From the Company Library, companies for this article are:

- GoTo / Gojek / Tokopedia

Photo by Gojek Media Resources

——-Transcription Below

:

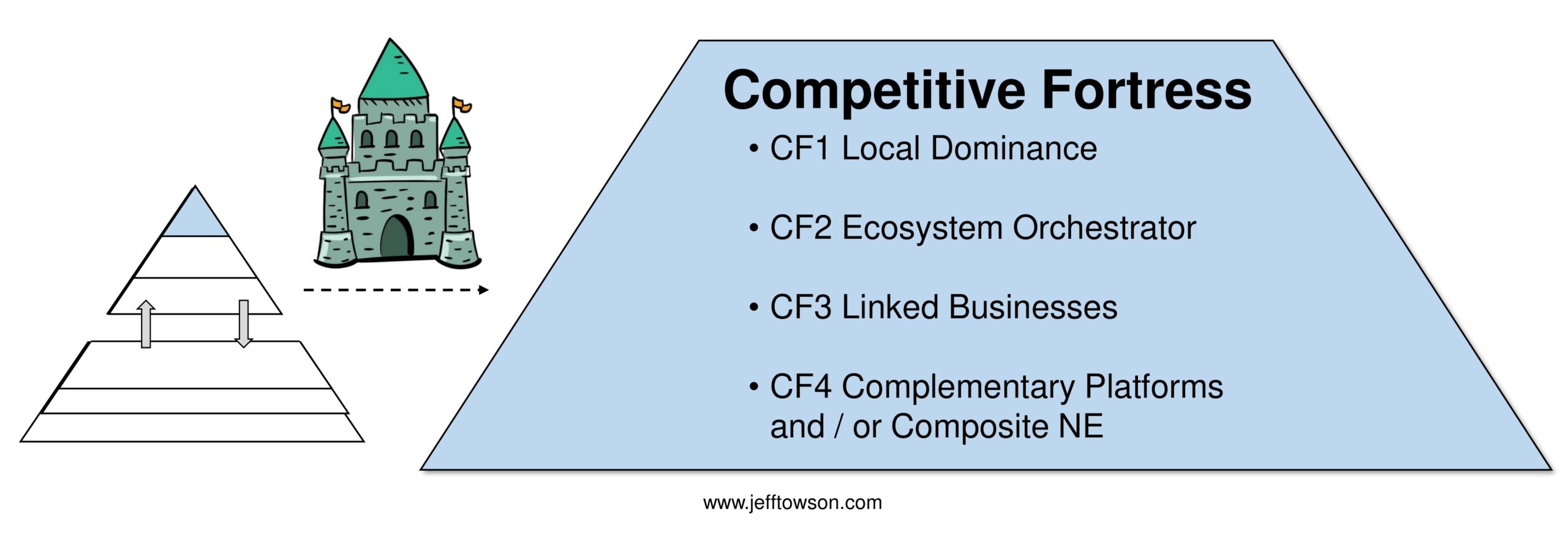

Welcome, welcome everybody. My name is Jeff Towson and this is Winning Tech Strategy. And the topic for today, will GoTo win it all in Indonesia? GoTo has just gone public. It’s a very, very interesting business model, really interesting strategy, a lot of good lessons in it. And I think the key question is, look, are they gonna win it all? Are they gonna dominate Indonesia? going forward and that’s a good strategy type question. So I think that’s sort of right in the strike zone. And I’ll give you sort of my answer to that at the end. Are they gonna win it all? Now, obviously I’ve kind of changed the title of the podcast and the writing and the newsletter and all of that. I basically migrated it away from, hey, let’s just look at stuff in China and Asia, which has been kind of my topic, to let’s just look at the best companies everywhere. A lot of them obviously will be China, Asia, but let’s just look for the best digital companies anywhere and try and take apart their strategy and see if we can predict what’s gonna happen. So hence the title winning tech strategy, which I’m not totally in love with. I’m not sure that’s an awesome, it’s kind of hard to say. My preference was for calling it bad-ass tech strategy, which I thought was funny, but then I suspect I’m the only one who would really enjoy that. So I’ve kept it with sort of winning tech strategies. And the idea is, you know, taking apart the strategies of the best companies. And by best companies, I’m using the acronym TIEs, T-I-E-S. I don’t really have a great explanation for how to remember that, just TIEs companies, which basically stands for Tech Leaders, Transforming Incumbents, Emerging Winners, and Small Giants. Because that’s kind of the kind of companies I’m always looking for when I think about strategy. I’m looking for the big leaders and trying to understand how did they become so successful. So that’s the T tech leaders. Transforming incumbents. These are this could be Walmart, could be Nike, could be L’Oreal. It could be companies that were very good traditional companies that have successfully transitioned or transformed, I should say, into digital companies as well. Those can be very effective. So that’s sort of the I, transforming incumbents. Emerging winners is a one, it’s a question that a lot of the investors are looking for. They’re looking for the smaller companies that are coming up, just, you know, recognizing them before others. So that’s the E. And then the S in ties is small giants. A lot of the best companies are not global leaders. They aren’t national leaders. They’re just really cool, smaller companies that throw off a lot of cashflow. So that’s kind of my acronism when I said, look, I’m going to try and take apart the strategies of the best digital companies, the ties companies. So leaders, incumbents, emerging winners, and then small giants. Okay. Let’s get into the topic. Oh, standard qualifier statement. Nothing in this podcast or in my writing on the website is investment advice. The. Numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. Now getting into the topic, I’m going to change the structure of these a little bit. I’m going to basically break these into three sections. Number one is just to do some company background, basic information from a strategy point of view. Number two, go through the key concepts or questions that I think you can learn from this company because we’re trying to take apart the strategies of the best companies. And then number three, get to the key question was, look, are they gonna win or not? So sort of one, two, three, and I’ll probably try to state that, although I do meander a bit from time to time. The concepts for today, which will obviously, so the company go-to is in the company library. The two concepts for today will be in the concept library. The two today are barriers to entry. and complementary platforms. Now I’ve talked about both of these before. A decent number of times, they’re in my books, but like a lot of the concepts I’ve been giving you, if you go to the concept library, there’s a good 30 or 40 digital concepts that are important, but you really have to go one level deeper than that. If I talk about marketplace platforms, okay, we know what that is, one of five platform types. We’ve talked about it a lot. But once you go from products to services, that’s very, very different. And when you start taking apart services, platforms for services, they can be very, very different depending what you’re doing. So when you’re going on to the next level, you start to see there’s lots of types for all of these concepts. Some of them are stronger, some of them are weaker. Well, it’s the same for complementary platforms and barriers to entry, which I’ve talked about before. But I’ve never really gone down the next level and say, look, some barriers to entry are really strong. Some are kind of weak. Some are getting stronger. Some are fading. Complementary platforms, same thing. If you put 10 cents gaming platform next to its WeChat platform, next to its payment platform, those are very complimentary and they strengthen each other. Other types of complimentary platforms, it doesn’t really work very well. So I’m gonna try and take both of those ideas sorta down to the next level. And I think GoTo is a really good example of, I mean, I’ll give you the so what. I think the complimentary platforms of GoTo are much, much weaker than other types we’ve looked at. But I think their barriers to entry are pretty compelling in the future, but not today. I’ll explain all that, but that’ll be it. My take is something like that. Okay, so those are the two concepts for today. Now, GoTo, which was formerly Go-Jek, a really interesting company. This company, I mean, it got my attention like five years ago. I was, you know, this was back when Uber was fighting DD in China. We were all getting free rides in Beijing because of all the subsidies. You could get across Beijing for like $3. It was crazy back then. You know, that was kind of the… the ride sharing wars, although it was more taxi-hailing than ride sharing back then. And then out of Southeast Asia, we also saw Grab was kind of the major player, but Uber was in Southeast Asia as well, both based out of Singapore. And they were trying to go across eight plus countries and roll up Southeast Asia. So there was kind of two fights going on at the same time. And you know, Grab had been around since 2009. Although they really didn’t launch till 2011, 2012, but founded in 2009 by Anthony Tan. But they’d been around for several years and between them and Uber, that was kind of the Southeast Asian market. And then around 2015-ish, Gojek jumps into the business. And Gojek was based in Jakarta, focused on Indonesia, which… You know, if you ever look at the numbers of Southeast Asia, Southeast Asia is a very large market in the aggregate. When you add all the countries together, you get a couple hundred million people. It’s pretty sizable. But at the country level, the only country that is sizable in its own right is Indonesia. It is, you know, when you look at large countries, you’re looking at China, India, and then Indonesia usually. So the way you win in Southeast Asia is you either got to get the whole region. which is what Grab is going for, or you gotta get Indonesia, which is what Gojek was focused on. So anyways, you know, Anthony Tan co-founds Grab 2009. They jump into really three businesses starting in 2012-ish, ride sharing, food delivery, and then payment. Those were kind of their three services they were trying to go pan Southeast Asia with. Grew very, very fast. started in taxis with taxi hailing, you know, in Kuala Lumpur, moved to Singapore, then went across the region, very aggressive in their fundraising, very aggressive expansion. And that came out of, you know, the standard stories Anthony Tan wrote this as a business plan when he was a Harvard Business student, came back to work at his family’s, you know, dealership. They were in the auto dealership business in Malaysia. He launched MyTexi out of that, which is taxi hailing for taxis, that got renamed a couple times, GrabTexi, and eventually just became Grab. Okay. That was kind of the story of ride sharing in Southeast Asia. And then 2015, Gojek jumps up. Now Gojek, co-founded by Nadeem Makarim, I’m probably saying his last name wrong, sorry about that, who was famously sort of classmate of Anthony Tans at Harvard Business School. And so there’s always been these rumors of bad blood between them that like you know Nadim copied Anthony, but let’s be honest Anthony copied Uber. So I mean what are we talking about? But anyways I don’t know if those are true or not but those rumors have been around since like 2015-2016. Anyway so this is the same idea but we’re gonna launch only in Indonesia, focus on Jakarta, and you know by and large a late entrant into this business. But I remember looking in 2016, just sort of looking at the Southeast Asian numbers and looking at the numbers of Gojek. And I was like, where did this company come from? I mean, this company is absolutely going up like a rocket ship. It is surpassing grab in overall drivers. Its user numbers are crazy and it’s only been around, you know, Gojek was founded 2010, but they really, It was actually founded as a call center where you could call in and get rides. They didn’t jump into the app business until like 2015. So within one or two years, I mean, they really took off. And I remember looking at this and looking up what is this company and where did this come from? And what jumped out was, yeah, they’re doing ride sharing but they’re not using cars, they’re using motorcycles. which if you’ve ever been to Jakarta, makes all the sense in the world because that city has the worst traffic you can imagine. It’s impossible to get across town. The only way to get across town is with a motorcycle. So hopping on the back of a scooter makes all the sense. And we see that in other countries in Southeast Asia too, but I mean for Jakarta, it’s absolutely essential. And then you’ve got this massive population. So what kind of got my attention was this company is really moving up. And I like the fact that they’ve localized to Indonesia from day one. They’re in the services marketplace business, just like Grab, but they’re localizing to Indonesia from day one. That was interesting. Uh, and then the other thing which happened over the next, you know, one to two years, they just unleashed a suite of products. I mean, they just went crazy. It was product after product, I mean, not product service after service, after service. all for Indonesia, all to a large degree also localized. So you could call them Indonesia specific solutions, which is a really interesting approach to building marketplaces. I mean, these were solutions to very Indonesia centric or Indonesia specific problems. So, you know, they just had the suite of products, 20, 25 services very, very quickly. I’ll give you some examples if you’re not familiar. So, It’s like Go Bluebird, Bluebird if you’ve ever been to Indonesia, Bluebird is a taxi service. Okay, so that was taxi hailing. Everything’s got a go in front of it. GoCar, which is ride hailing, fine. GoRide, which is their online taxi motorcycle service. By 2018, they had more than a million drivers doing their motorcycles, mostly in Indonesia. They had a couple little footprints outside of Indonesia, but not very much. They became one of the largest e-wallets in Indonesia very, very quickly. By 2017, 30% of all e-money transaction in Indonesia were GoPay. 2017, they got a license from the central bank to use QR codes and things like that. They jump into food delivery, GoFood, 200, 300,000 merchants, the GoFood Festival, which was sort of an offline food court. where you could set up stalls and sell food and beverage. So it’s sort of like an offline version of GoFood, which is actually a really cool idea. I wish they would do that in Thailand. GoMart, which is hooking you with local supermarkets, convenience stores, things like that. GoShop is similar. GoSend, where you can send packages across town using the same dudes on scooters and motorcycles. GoBox, sending larger things, which you’re gonna need a truck. Go Tix for buying movie tickets, go Med for getting your medicine delivered. Go Massage, you can get a personal masseuse. Go Clean, people come clean your house. Go Glam, they will come to your place and do your hair, your nail, your makeup, whatever. Go Auto, you can schedule auto care for, you know, get your car washed, get an emergency repair. Go Pulse, which is credit top up for your phone. Go Bills, pay all your bills. Go Points. Go Play, which is online content. I mean, they just went service after service after service. And that’s, you know, what jumps out at you is that sounds a lot like Meituan. I mean, it really sounds a lot like what Meituan did for China. Let’s not be one or two services like ride sharing and delivery. Let’s not be services focused on a niche like we’re Ctrip and we only do tourism and hospitality. let’s just do an entire suite of services that are localized for an area, and it kind of becomes your daily lifestyle app for getting stuff done in life, which is really what Meituan did, and I always liked that about Meituan, and they kind of did the same thing, and then at a certain point, Meituan invested in Gojek, but a lot of the Chinese companies invested in these companies, so that’s not as meaningful as it sounds. Anyway, so. One of the reasons Gojek was really sort of on my radar for a long time is because I liked the strategy that doing a suite of localized services just for Indonesia was a very smart counter strategy to grabs we’re gonna go for all of Southeast Asia with one, two or three pretty much standardized services. So I thought it was a great, I mean the way I used to think about it was grab regional versus what I was calling like the Indonesian fortress, that it was kind of almost like a national super app just for Indonesian. I thought that was a great counter strategy. And I also think there’s some good lessons in there in how marketplaces, because this was a marketplace for services, right? So you draw this as a platform business model marketplace, small merchants as one user group, consumers as another, and then you just keep expanding the number of merchants and restaurants on the other side. I also thought there was interesting lessons in there in the evolution of marketplaces for services. That maybe what we were thinking about in terms of services, you know, online travel agencies, ride sharing, mobility, travel, hospitality, maybe that was just the first iteration of what it means to be a services marketplace, because we kind of took the existing physical world like with travel agents. or with taxi stands, and we just digitized what was already there and made it into a platform, which is Expedia, Booking.com, Agoda, C-Trip, and so on. But maybe what Gojek and Meituan did is they jumped to the next evolution, which is there’s no reason to limit the services you offer to these old industry verticals that we don’t even think about anymore. If I’m on my phone, does it really matter if I’m buying a movie ticket or a plane ticket, really? So maybe this is the next evolution of marketplaces for services for consumers, B2B. I’m sorry, B2C. So I thought that was an interesting question and I’m pretty much a believer that that is the case. Now, the other idea that this sort of tees up is, okay, that was, I just gave you the Go-Jek store. Now in addition to Gojek, we have Tokopedia, which is an e-commerce marketplace for products for Indonesia. So marketplace for services, Gojek, marketplace for products, Tokopedia. What’s the difference? Well, the operational requirements are different. When we look at a marketplace for services, we start thinking about lots of people on scooters. That’s your sort of enabling capability. When you start thinking about marketplace for products that’s Taobao, Shopee, suddenly you’re enabling capabilities are warehouses, logistics, payment, escrow, things like that, you know, on demand services are very different than shipped products. So these really are sort of two different businesses in the operational requirements. And I generally like marketplaces for products better. because the physical aspects of the businesses create a larger barrier to entry, because it’s not that hard to get a bunch of people on scooters in one town and start delivering stuff. It’s very hard to blanket a country with warehouses. So I like that aspect a bit better. But okay, so Tokopedia, also Indonesia, and then Tokopedia merges up with Gojek, and we start calling it GoTo, and they go public. And if you look at the filing, which someone sent me a translated version because it’s in, I don’t actually know what the language is. It’s not Indonesian. I don’t think there’s any such thing as that language. Anyways, a language I cannot read. But you basically, what you’re seeing is you’re seeing two platform business models in the same company. You’re seeing a platform marketplace for services, mostly on-demand services. and then you’re seeing a platform marketplace for products, very similar to a Taobao. Okay, you put those in together in a company and the way I would typically describe this would be two platform business models that are complimentary. They should in theory help each other. And from the consumer perspective, it’s all the same. I can buy makeup and I can have someone come and put the makeup on. I can get my food delivered, I can buy milk for the fridge, and I can also buy sneakers. You could argue that this is what you would call an ultimate B2C marketplace. And for those of you who are subscribers, I sent you an article about this, you know, this idea that will we see these ultimate B2C marketplaces where, you know, sort of one app has everything a consumer would need. And companies like McKinsey have argued this is probably going to happen. I’m not totally a believer in that. But. This would be an example, and that was the email I sent you the other day, is GoTo going to become an ultimate B2C marketplace? And my answer is, I don’t think so. I think Alibaba tried this three to four years ago with Taobao combined with Ulema, and it didn’t really work. Now they still have Alibaba, Taobao, they still have Ulema, but they aren’t integrated in any significant way. They’re just two different apps that Alibaba owns. Now they do some cross marketing and things like that, but by and large, these are not two platforms that really help each other and are really integrated. It’s more like we have two good businesses and we share some data and some marketing and some IT. It’s more like a conglomerate than a complimentary platform. But the idea is, okay, we’ve merged this into GoTo, and when we look at the numbers, we see those. two platforms, on-demand services and a product marketplace. And then in addition, they have financial services, but we’ll sort of ignore that for now. NetNet, 55 million yearly transacting users. And whenever a company gives me their yearly transacting numbers, that’s not a good look. Like if they’re not telling you daily or monthly, they’re kind of jerking you around a little bit. When they tell you the annual number of users that do transactions, who uses annual numbers for that? No, it should be monthly. So when they say 55 million annual transacting users, that’s a little bit of a, not a red flag, but it’s not awesome. 14 million merchants and then 2.5 million drivers. Okay, so they’re big in Indonesia. And the number that got my attention from their filing was They say that the gross transaction volume on their platform could reach two thirds of all Indonesian household consumptions. Now, when you hear a company start talking about the GTV of their service as a percentage of all household spending, that is an ultimate B2C marketplace argument. They’re telling you that their TAM, their total addressable market, is everything that households spend. and they think it’s two thirds. And this is, you know, Alibaba calls this share of wallet. Okay, so they’re talking in the language of an ultimate B2C marketplace, much like Alibaba does. So, I mean, you could make this argument that Gojek was a really compelling business model suite of services, I like that one, especially versus Grab outside of Indonesia. This argument, we’re gonna put products and services together into an ultimate marketplace, and it’s gonna… increase our TAM to two-thirds of all household spending in Indonesia. I’m not sure I buy that. I believe the first bit, the Gojek bet, I’m not sure I believe the GoTo story. That’s kind of where I am on that one. But it’s an important point to think about. It could it could well evolve in that direction. So that’s sort of part one. That’s a bit of the history of Gojek plus Tokopedia resulting in GoTo and you know… Part of the story is compelling, part of it I’m not totally sure about, but there really is a lot to like there in terms of their position within Indonesia. Okay, now let me move over to sort of the concepts and what I think the key strategy questions are going forward to sort of predict whether this company’s gonna win it all or not. Now the two concepts for today, complementary platforms, barriers to entry. When I look at this company, the questions that really jump out at me are… I understand the whole Gojek picture. I think I can sort of get a good read on Gojek as a standalone platform business model. There’s a lot to like. It’s got the suite of services I mentioned, which is a very competitive offering. It’s very hard to match that. Let’s say you’re Grab. It has a dominant brand. It is a local champion for Indonesia, so the government is very much on their side. And it’s a standard marketplace platform. There’s network effects, there’s a chicken and an egg problem. Now, marketplace platforms for local services, whether it’s Uber, Didi, Grab, Go-Jek, they are not the strongest platforms. And we’ve seen that in their economics. We’ve seen that in the ease of entry, of jumping into these businesses. Generally speaking, they’re not, you know, marketplaces for products like Taobao, like Shopee, like Tokopedia. Those tend to be stronger business models with more attractive economics. And we’ve seen that in country after country after country. Okay, so I think we could assess them both individually. We put them together. And the question then is, okay, this is somewhat of a complementary platform. Is it a strong or a weak case of a complementary platform? Now, if you look at my six levels of competition, the top of the, you know, the top number one level, the competitive fortress level, which is the best place you can ever be as a business, in my opinion, on that very short list of phenomenon are, is complementary platforms. If you have a complementary platform business, you are a competitive fortress. It is almost impossible to take you down without some sort of technological disruption or change or regulatory action. Your competitors probably can’t touch you. And types of complementary platforms I’ve pointed to in the past are like Taobao. with their payment platform and with their entertainment sort of audience builder platform. Those can be very powerful. I think Google is a complementary platform. They have multiple, you know, they have their search engine, they have YouTube, they have their suite of tools, they have Google Maps. They have multiple platform business models that all really do make each other better. And that’s the difference between saying, look, you’ve got two businesses, that’s good, conglomerate. No, no, I’m talking about complimentary linked businesses where each business makes the other one stronger, such that if a competitor only has one of those, their one offering is not as good as your offering in that area because they don’t have it. If you have a search engine, let’s say you’re a competitor to Google, you’re Bing, your search results are not gonna probably be as good as Google search because you don’t have YouTube. and YouTube results feed right into the Google search. So when you search for something, you’re gonna get text, you’re gonna get videos and images that are gonna be better because they’ll probably put a walled garden around that and won’t let your search results show up. So I’m looking for linked businesses. And if you look at my competitive fortress, I’ll put the graphic in the show notes. I’ve actually listed two under competitive fortresses. I’ve listed linked businesses. and complementary platforms. Complementary platforms are a digital type of linked businesses. If you have two businesses that help each other significantly, that can be powerful anywhere. NASCAR is an example of that. This is sort of a famous case, like one guy or one company owns the stadiums where these cars race around, and they own the media company, the racing company NASCAR. And if you’re trying to compete with this business, it’s very difficult because if you want to launch a racing company, you know, the Jeff Racing Company, which would be like a NASCAR, for me to do that, I have to get access to all the stadiums, but I can’t because they own those. Okay, if I want to start a stadium company to launch that, I’m going to need racing companies to host their events there, but they own that one too. So I have to have both of them. get into this game as opposed to just one. So it makes it much more difficult. Okay, that’s a linked business. A complementary platform is just two linked businesses that both happen to be digital powerhouses with your platforms, so it’s better. Hence, those are both in my little list there. Okay, so the question is, is GoTo a weak or a strong complementary platform as a business model? Google is very strong. Facebook is not bad. Microsoft is quite strong. Taobao is strong. Tencent is very very strong. I would put Garena and Shopee as sort of medium at best because I don’t think their two businesses help each other that much. They do somewhat. When I look at GoTo, it looks fairly weak to me. as a complimentary platform. I think the complimentary, that sort of competitive advantages that play out are not terribly strong between them in terms of, yes, there’s some sharing of R&D, but the truth is there are two businesses have different R&D, so you don’t get joint economies of scale between the product platform and the service platform. I think the IET tech stack that they’re investing for both of those is also some pretty specialized and I don’t think one tech stack helps the other that much. I think there’s some decent overlap in marketing spend, fine. So there’s some economies of scale in marketing spend and data, that’s good. I think the customer offering that they make. doesn’t look significantly better to me than a standalone services marketplace or a standalone product marketplace. I think if you’re buying stuff on Tokopedia, it’s not that different than buying stuff on Shopee. And I think if you’re buying stuff on Gojek, the fact that they have Tokopedia is not changing that dramatically. Now they could. And this is sort of one of my number one is probably my number one question for go to going forward. Are they gonna start to bundle products and services together, which is what Alibaba is doing in China? That would be competitive. That would be a customer offering that their competitors would be very strained to replicate, where they say, we will sell you the makeup and we’ll have someone come to your house and apply it at the same time and cut your hair. Product service bundles, I think, are fairly compelling. And that’s really what Alibaba is pushing in China right now. So I’m watching for them to do that. I don’t think they’re doing that today, although they do mention it in their filing, starting to do bundling. So that’s okay. But generally, I don’t see a whole lot here that is a game changer in the services platform or the product platform versus competitors by virtue of the fact that they have both. They could in the future, I don’t see it yet. And I didn’t see Alibaba do anything like that in China when they had both platforms as well. So overall, my working conclusion, complimentary platform, not terribly strong in this case, pretty weak. All right, question number two. Does this digital physical hybrid have strong or weak barriers to entry. Now I’ve talked about digital physical hybrids before, when you have a business that has a lot of physical, tangible assets like warehouses and trucks and things, and digital assets like cool apps and videos and stuff like that. When you have both, you get a really nice benefit in terms of your barrier to entry. Replicating all of JD’s warehouses across China, which is what it would take to jump into their business, is very difficult and takes a long time. So the physical assets create the barrier, the digital assets create the profitability. It’s literally like my favorite business model. Let’s say it’s on the short list. It creates a barrier to entry, among other things, when you have a digital physical hybrid. Okay, so does GoTo have a stronger or weaker… barrier to entry by virtue of being a digital physical hybrid. Now my standard question which I’ve talked about before is when I assess barriers to entry, and this is in my book, I talk about it a lot, my standard question is, what is the cost, timing, and or difficulty for a well-funded, well-run competitor to jump into this business and take 20%? That would be overcoming a barrier. You know, there’s a barrier to entry. We’ve jumped it by taking 20%. What would be the cost, timing, and or difficulty? And I’ve talked about this before, you know, the cost. Look, is it just a matter of spending money? Do we just have to build a bunch of warehouses? How much is it? Is it a little bit of money? Is it a lot of money? What is the timing? Is this something we can just write a huge check and do it now? Or does this take five years no matter what? If you want to create a famous brand, there’s no way to really spend your way there quickly. This is why legacy brands like Coca-Cola are so strong because you can’t just write a check and put billboards all over town to build a powerful legacy brand that can compete with Coke. You’re gonna have to spend for 10 to 20 years because that’s what they’ve been doing. Such that everyone on the planet grew up hearing this name. So it’s not about the cost, it’s about the timing. There’s no way to force it. The other one is just difficulty. Is it hard to get the license? Is it hard to get the really good location on Waikiki Beach no matter how much money you have? Is it difficult to get your drug through clinical trials no matter what? Is it difficult to create a social network? You can’t just buy a social network by spending money. you know, it’s a difficult thing to build as an asset. So I look for sort of those three things, cost, timing, and or difficulty. Okay, so we look at Go-Jek, the service on-demand service business. The difficult thing here is to replicate the marketplace platform, chicken and an egg problem. You gotta get one side of the platform to get the other side. So there is a certain amount of difficulty. in building a marketplace platform no matter how much money you spend, particularly when there’s an incumbent that’s going to fight you. The cost is pretty significant, the timing is limiting, but generally speaking Go-Jek as a platform has a moderate barrier to entry, which is not bad. Okay. But the problem with that… is it turns out it’s mostly a local phenomenon. If I wanna compete against Gojek as a services marketplace, I don’t have to go everywhere in Indonesia. I just have to go to Jakarta. In fact, I could just go to one neighborhood in Jakarta, hire a bunch of drivers, sign up some local merchants, hand out an app to everyone who comes down the street, and I could build a local marketplace for services. So services marketplaces, because they’re so local, the barrier is actually much lower than it appears. And this is why we see companies jumping into these all the time. So the Go-Jek thing, it’s a bit of a mix. I don’t like that it’s overwhelmingly local because it makes it easier to jump the barrier. I like the fact that they don’t offer two services, they offer 21 or 23 or whatever it is now. That makes it much harder. So I kind of, I put that as an okay barrier to entry, but not awesome. by virtue of suite of services. And then you could switch to the product marketplace, Tokopedia, what’s the barrier there? Now, generally I like marketplaces for products better because you have to replicate the marketplace platform, which has a chicken and an egg problem. You also have to build all the warehouses. You have to build all the robots. You have to sign up all the merchants. The digital physical hybrid aspect is much more powerful on. product marketplaces than services marketplaces. That’s why I like a company like JD so much, because of that. Okay. So if we put those together, does it raise the barrier to entry? And I think overall I would put this as fairly weak. Now why? because at first glance that story sounds pretty good. Oh, this is like JD for Indonesia and Indonesia is a massive country. The problem is Indonesian e-commerce is actually very, very underdeveloped. For all this talk about this is one of the world’s largest populations, the vast majority of the orders and users are coming from two to three cities. Jakarta. obviously Surabaya and the other one is just outside of Jakarta, I forget the name. Even though the story is hey this is a massive country with tons of islands and it could be an incredibly marketplace in terms of barriers to entry. The truth is it’s very early days and most of the usage is coming from a couple places and it would be fairly easy to break into those places. So the developed e-commerce story of Indonesia is really compelling, but we’re not there yet. We’re in the still developing phase, and I think the barriers are much lower than they first appear. And Goto talked about this in their filing that they’re getting most of their business from a couple cities. And I’m willing to bet if they break out their services, they’re getting most of their service activity from a handful of services, not all 21. So the barrier, my conclusion on this is the buried entry is lower than it appears, mostly because of the still early phase of development of e-commerce in Indonesia overall. And we could have said the same thing about China in 2005. We could have said, oh my God, China’s a huge market. E-commerce is gonna be massive. But when you sort of look a little deeper, you’re like, look, most all of the business is coming from Shenzhen, Shanghai, and Beijing. That’s it. Now today, that’s not the case, but it was in 2005. It was a very small number of people actually online in 2005 and they were in a couple cities. So that kind of pulls away, I think, a lot of the cool story aspect. Okay, so that’s kind of where I fall on that. The two key questions I was looking at is, is the complementary platform business model in this case, strong or weak version of this? I think it’s a fairly weak version. Is the barrier to entry by virtue of a digital physical hybrid and other things, strong or weak? I think it’s actually fairly weak right now. So, both of those key ideas, I put them more on the weak side than say the strong side. Now that said, I still like Gojek as a business model, I still like Tokopedia as a business model. But it ain’t the complimentary, you know, picture that we see in Taobao or Amazon or Microsoft or Google yet. And that sort of brings me to, so those are the two concepts for today. And that kind of brings me, okay, last section, last point. Look, are they going to win it all in Indonesia? Yes or no? What’s my take? And my answer to that is yes. I think GoTo is going to win it all in Indonesia. I think they’re going to be. the dominant e-commerce company of that country. However, that’s not yet today. I think that’s the trajectory they’re headed on. I think today by virtue of being fairly early days of development of Indonesia, they don’t have that competitive power today. I don’t think they have the unbeatable service offering today. I think they’re moving in that direction. but the rate of movement is not being determined by management, it is being determined by the rate of development of e-commerce in Indonesia, which is largely outside of their control. And their numbers are going up, you can look at the filing, the numbers are going up, but they ain’t doubling, they ain’t going up 100% per year, they ain’t going up 50%, they’re steadily increasing with the sort of development of the country’s infrastructure and e-commerce space. That’s kind of where they are. So in three to four years, three to five years, this could be the winner take all powerhouse of Indonesia. That is clearly where this ship is heading, but it’s not there yet. And we’ll see. Right now I don’t see any major competitors that are a threat to them. I really don’t. But until they sort of get to the promised land, until they get to the top of the mountain, and build their fortress, they are still vulnerable to an attacker. So I’m watching for attackers. But three to four years from now, I think my tune could be very different, which is they’ve won it all. They’re untouchable. Game over. But they’re not there today. That’s how I answer the question for this podcast. Are they going to win it all? Yes or no? Not yet. Maybe in a couple of years, they’ll have it. But things are looking pretty good. There’s a lot to like with this company, even though the financials are not too pretty at this point. But I think that’s to be expected. Okay, and that is it for the content for today. The really three concepts, I guess. Barriers to entry, complementary platforms, and then I touched on digital physical hybrids. As for me, it’s been a pretty great week. I am really pleased to be home. out of hotels, having a nice time. I got to finish up all my taxes in, I’m basically under the jurisdiction of five different countries when it comes to taxes. So I had to do three different filings in different geographies and then exempt from two others. So that’s a little bit of a negative of my sort of nomadic global lifestyle is. I do get to do taxes in quite a few countries, which is, I like to complain about it. The truth is I kind of find it fun and I’m not totally sure why I find it fun. It’s just, you know, working out all the numbers is a little bit fun. Anyways, so I got to finish that up this week, which was not terrible. No big deal really. What else? No, I think that’s it. I guess question, this is a new format. Well, not I haven’t changed it too much. Let’s say I’ve repositioned it a bit. If you have any suggestions for this, please let me know. I think it’s focusing more on lessons and strategies from the best of the best in terms of digital companies is I kind of like that, but let me know what you think. And also if you have a better idea for the title, as opposed to winning tech strategy, I kind of like it. It’s okay, I’m not in love with it. It’s a little hard to say. I’d like it. I think it captures the idea, right? How tech strategy where you can win. The tech strategy of the greatest companies, the winning companies. I like that as an idea. The language is not awesome. If you have any suggestions for that, let me know. I’d appreciate it. Okay, but that is it for me. I hope everyone is doing well, and I will talk to you next week. Bye-bye.

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.