This week’s podcast is about the US-China DTC retailer Shein, which has rocketed upwards in the past months. Analysts are starting to pay close attention – but consumers have been noticing this company for a while.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

The mentioned article by Packy McCormick and Matthew Brennan is Shein: The TikTok of Ecommerce.

—–—-

Related articles:

- JD and Competitive Advantages vs. Entry Barriers in China Retail (Daily Lesson – Jeff’s Asia Tech Class)

- JD and the Power of Production Cost Advantages in Retail (Daily Lesson – Jeff’s Asia Tech Class)

- Don’t Go Gaga Over Shein’s “Ultra-Fast Fashion” Model. It’s Mostly a Low-Priced DTC Apparel Story. (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Competitive Advantage: Rate of Learning

- SMILE Marathon: Rate of Learning

- Share of Consumer Mind

- Economies of Scale

- Bargaining Power with Suppliers / Purchasing Economies

From the Company Library, companies for this article are:

- Shein

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

—–transcription below

:

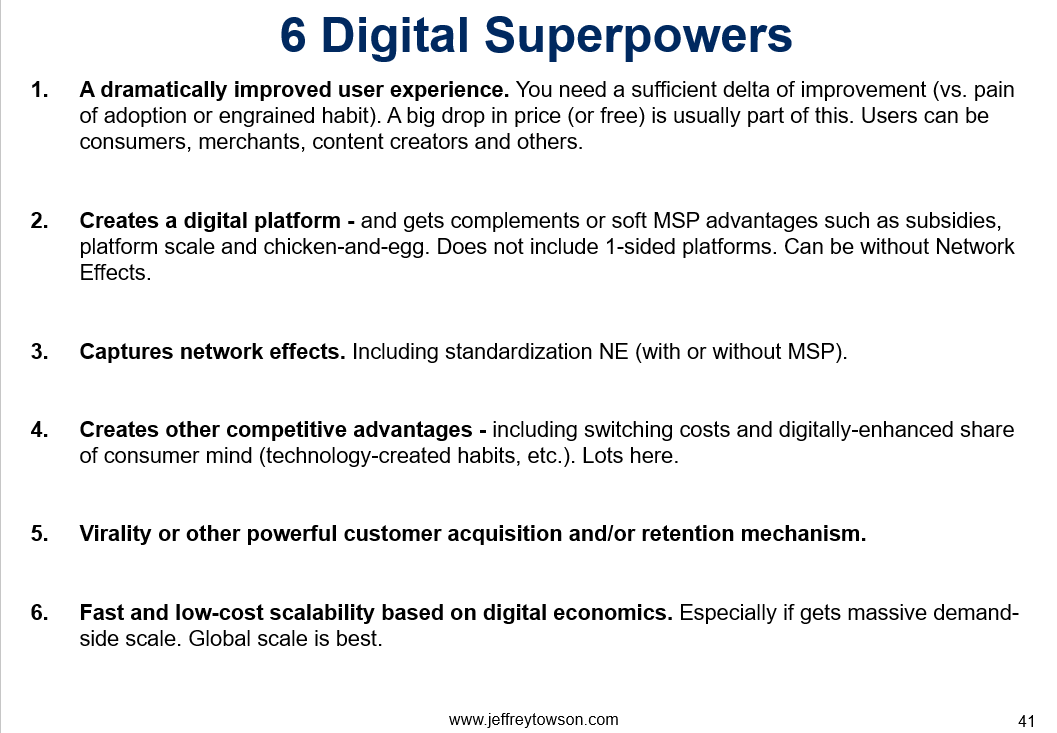

Welcome welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, Shein does cheap DTC apparel at the speed of algorithms. Is it a moat or just new table stakes? That’s a bit of a long headline, but hopefully this will be a sort of a fun question. It’s kind of a big subject happening in the last couple weeks. And I think there’s a lot of sort of angles emerging on this really. Phenomenon. I mean this is the next Chinese company to really blow up in the United States on the consumer side after TikTok So a lot of people are kind of looking at it. I’ll give you my take Now let me apologize a little bit. I’m in Juarez, Mexico, which is just across the border from El Paso Hanging out here for a couple days. I’m getting my My second covid vaccine tomorrow, so that’ll be done But there is kind of a lot going on where I’m sitting recording this There are dogs barking outside. There’s some music going on. There’s people having dinner nearby. And I thought it was a bunch of motorcycles, but it just turned out to be someone playing Xbox nearby. So anyways, this might be a very loud, sort of unusual podcast, but I’ll try and tune most of that out or filter it out at some point. Now, for those of you who are subscribers, I sent you a couple thousand words on Shein in the last day. I’m gonna kind of build on that. and sort of move it forward a bit, basically because my thinking is evolving on this. The issue with Xi’an is there’s not a lot of information available. It’s private, it’s based in China, Guangzhou, very either secretive or private or just off the radar, but there’s not a lot of info, so a lot of this is guesswork. Although you can go onto the website and the mobile app and you can learn a lot about them there. but I’m gonna build on what I sent you in the last day or so. And for those of you who aren’t subscribers, feel free to go over to jefftausen.com. You can sign up there, free 30 day trial. Try it out, see what you think, join the group. And with that, oops, I gotta give you my disclaimer. Standard disclaimer, nothing in this podcast or in my writing on my website is investment advice. The numbers and information for me and any guess may be incorrect. The views and opinions expressed may be incorrect or no longer relevant or accurate. Overall investing is risky. This is not investment advice. Do your own research Okay, let’s get into the topic now as always I want to sort of point out the key concepts that I think are relevant here And you can always go over to the concept library and click on them, but this is really my let’s say 30 to 40 Key ideas digital concepts really that we keep touching on over and over I think you see this in a lot of these companies. It’s good framework for talking about them And as I go through companies, I try and point out two or three. So it’s a good way to sort of learn gradually as we go through companies and situations. But the concepts for this, which will be in the show notes as well, are share of the consumer mind, economies of scale, of which there’s a couple of varieties I’ll talk about. And then rate of learning, which is actually really important, but nobody really talks about it that much. Everyone talks about economies of scale. It’s like the go-to competitive advantage. People don’t really talk about rate of learning as either an dimension and also as sometimes a competitive advantage. So that’s kind of be a big part of what Shein is doing. Okay, now I’m gonna go through sort of the basics of this, but if you follow this company at all, you’re gonna hear the same stats because there aren’t that many of them. So I’m gonna probably repeat what you’ve heard. And a lot of this is drawing on an article, which I believe many of you have read by Paki McCormick and Matthew Brennan. on Xi’an and they kind of did some degree of research to dig into this company and find more about it because there’s a lot of false information about this company out there. For those of you who don’t know, Packey’s a sort of he talks about tech companies in the U.S. and he occasionally looks at a China company. Matthew is an old sort of fellow old hand in China. He’s based in Chengdu. A really good dude. Matthew if you’re listening, hey how you doing? We’ve had him on the podcast for a while and we run into each other places like I don’t know, WeChat headquarters and things like that. But he wrote a book recently called The Attention Factory about bite dance, which is great. Really good thinking. He’s someone you should pay attention to. Anyways, him and Packey wrote or collaborated or something on this article. And so a lot of this information is coming from that. About 70% of it. There’s really not that much out there on this company. Okay, here’s kind of the quick and dirty summary of Xi’an, which is like this is a China based e-commerce company that does not sell in China and it’s direct to consumer which means basically you’re selling online and you’re connecting factories with boxes to people’s homes right no retailers no distributors none of that it’s a direct um DTC mark model which is very common in China and it’s very common in the US to US consumers. And then they’re also doing far beyond that now. But I’m pretty sure if we saw their numbers, it’s mostly about the US. They’ve kind of blown up recently in the US. In the last week, they hit sort of Amazon level of download numbers. And briefly, on the iOS store in the US, they surpassed Amazon as the number one downloaded e-commerce app in the US. And then Amazon’s number one again. But that was kind of a big deal. It got people’s attention and people started making the comparison. Hey, that’s what TikTok did about a year ago. And TikTok has been the number one or close to a downloaded app in the U S and really globally and against the Chinese company. So this could be another TikTok like phenomenon. Um, the numbers on revenue, which I don’t know who knows the number people say is that they’ve reached 10 billion dollars, U S dollars in revenue in 2020, which was a hundred percent increase. 100% increase. Apparently it’s going up. Who knows? But it’s sort of a cross-border US-China cross-border e-commerce play that’s DTC, direct to consumer. That’s kind of the first quick and dirty summary. The other one is, okay, the factoid that’s going to be relevant for our discussion, well, me talking at you really, is the report is they upload, launch, put on their website a So they’re a retailer, they have a website, they have a mobile app, but they’re also a brand, Shein Brand, you can find their goods on Amazon, you can find them on AliExpress. So they’re a brand, an apparel brand and retailer, but they’re loading up maybe a thousand new products every single day. So there’s this argument that, hey, this is like fast fashion, but it’s really fast. In fact, it’s super fast, it’s like real time fast. Is that a game changer, is that a competitive advantage? And that was sort of the title of this podcast, was that, look, Shein is doing low priced DTC apparel at the speed of algorithms. Is that a moat or is that just kind of the new table stakes and everyone’s gonna do that? Way we can invert this question is is Shein doing anything that can’t be copied? Because okay, they’re first, but people are gonna see what they’re doing and they’re gonna copy. Are they doing anything that can’t be copied? If not, then this is just the new table stakes. for this type of business model. If they are, then maybe they’ve got their first and they’ve got a moat. That’s kind of the question I’m thinking about. Now, some more background on this company, and this is from the Paki Matthew article, which I’m gonna put a link in below, so that’ll take you over to that website. But some of the stats I’ve literally just pulled right from their article. Shein ranks number one in the iOS app store, shopping category for 56 countries. And it’s in… the top five spot, or it’s in the top five, for 124 countries out of 174. So this thing is everywhere. Since mid-February, Shein has an unbroken run of being ranked second only to Amazon for shopping apps in the US. Shane’s website ranks number one in the world for web traffic and fashion and apparel. And that puts them ahead of Nike, Zara, Macy’s, Luluman, Adidas. The average duration of a site visit is 8 minutes 36 seconds, higher than every major US fashion brand, and it is arguably, according to a report, the most talked about brand on TikTok in 2020. Okay, now what does that mean? I don’t know, but it’s everywhere. If you want to have some fun, go onto YouTube and type in Shein in general, or type in Shein try on haul. Like try on haul. and you will see vlogger after vlogger after vlogger doing a try on haul where they get a box from shein full of stuff and then they try it all on. They’re everywhere. They’re on TikTok. They’re on Amazon. They’re on YouTube. They’re on Instagram. They are everywhere on the social media side. And what most of these influencers, vloggers and such are going to say in the first 30 seconds is the prices were so low. Wow, look at the low prices. And if you go on the website you’ll see stuff, you know, tops, socks, halter tops, bikini tops, I don’t know, women’s clothes. This is all women’s clothes, by the way. It’s an apparel store, but it’s all for women, mostly. Six dollars, seven dollars, eight dollars. So it’s a massive selection of really low-priced women’s clothing. Now, I used the word cheap in the introduction. If you’re a Cheehan and listening to this, sorry about that, I shouldn’t use the word cheap. I should have said low-priced. I’m not implying it’s low quality. It’s very low priced, as far as I can tell, acceptable quality clothing. And people are just having a ball buying it and getting it shipped in these big boxes. And it looks like they’re having a lot of fun. Okay. So as much as everyone talks about the speed and the uploads and the thousands of new products and such, the biggest lever that’s happening here is low price. How are they doing that? Well… The DTC model in general is lower cost structure. You get rid of the physical stores, you get rid of the retailers, you get rid of the warehouses and the distribution, and you go right from the factory to the consumer. That is generally lower cost. And then when you do that between China and the US, you’re basically leveraging in Chinese manufacturers, which, I mean, that’s crazy low cost. If you ever, DTC is actually really common in China. You see it in lots of product categories. People are always buying things. You see this. all the time, contract manufacturing and apparel prices in China, DTC and pretty much any online thing, really low price. So to some degree what’s happening here is US consumers, young women mostly, are getting to start to buy clothes at Chinese clothing prices. And that’s, you know, that’s a big deal. Don’t underestimate the power of being cheaper for stuff that people already want. that’s kind of one thing that’s going on. Number two, they are overwhelmingly about women’s fashion. Apparel and fashion obviously a massive category of retail and is overwhelmingly women. They apparently have got some degree of traction hooks at least interest by gen z women who happen to be active on places like social media, tik tok, things like that. So you can see how that lines up. And she in number three appears to be particularly agile. and just really good at digital marketing, social media, influencer marketing. And the founder, Chris Hsu, his background, I mean, his literally his first job was cross border e-commerce and within that doing search engine optimization. So he’s always had a foot in cross border e-commerce and digital marketing. So that’s kind of… Interesting. Anyways, I encourage you to take a look at their webpage. Just type in she in. Doesn’t matter what country you’re listening to. It will probably pop up with a local country version. Skim down the pages. You will see picture after picture after picture of really attractive women, by the way, with various clothing items that are all crazily low priced. Okay, some more basic background. And again, this is all from the Paki Matthew article. I’m trying to give credit because I don’t like citing other people’s work generally. The company was founded in 2008 by Chris Xu, who was a recent graduate of the University in Qingdao. I believe Qingdao University of Science and Technology did a short stint as a consultant in cross-border e-commerce, as mentioned, doing search engine optimization. And then fairly early on he seems to have jumped out with some colleagues and founded this company. It looks like they were just sort of struggling a bit, small scale, for three to four years doing cross-border e-commerce, which is basically like going down to the local distributor in a Chinese city, finding items, buying them from warehouses. And you know, this is wholesale basically. And then, you know, selling it to the US with a website and putting it in boxes. So it’s kind of like buying stuff wholesale, trying to reach US consumers mostly, as far as I can tell. shipping it to him. And within that sector he honed in on at some point the idea of apparel as an area. And specifically, this is a quote from the article, customized special occasion apparel, which a big part of that appears to be wedding dresses. Why? Well, because it turns out in the world of e-commerce, apparently, I didn’t know this, two of the biggest sectors are electronics and like wedding dresses. bridesmaids, groomswear, formal evening wear, graduation dresses, things like that. But you know basically these are one-time items that might be bought in the US. Wedding dress $1,000, $1,200, something like that and suddenly you’re putting it up from China at $200, $300. Apparently this was their first sort of breakout product was wedding dresses and as I kind of mentioned like the low cost lever, the low price lever, seems to be the biggest thing going on in terms of getting attention and traction. Now that doesn’t mean it’s easy. It’s actually you have to overcome quite a few things to make those transactions happen. I mean, people just don’t go online and say, ooh, this is a wedding dress that’s really cheap from China, I’ll just buy that. No, because they immediately say, oh, this might not be any good. So you have to sort of build up trust, you have to build up a brand, you have to have returns. You have to… deal with that level of uncertainty such that someone says, hey, this is going to be a $200 dress instead of a $1,200 one, and the quality, I think it’s fine. You have to sort of build that. It’s not an easy cross-border sort of question to solve. So from there, they started doing that same play, as far as I can tell. And then another turning point happened in 2012, 2013-ish. They started to get more active on newly emerging social media. Sheehan was one of the first companies on Pinterest, which was very new back then, and became one of its top sources of traffic. So you can see they’re sort of putting the pieces together very early on, but with a relatively small number of products, and then over time the number of products just grew and grew and grew. But it doesn’t look to me like they’ve deviated from that same basic playbook too much. Now they did evolve it a bit where they stopped buying wholesale and they started designing their own clothes, their own brand name, and then contracting manufacturers to make the clothes for them. So they sort of vertically integrated backwards. And then they started moving forward in more dimensions like own webpage, own mobile app, store within AliExpress, things like that. So you can see they sort of fleshed it out and grew over time and got a lot more sophisticated on both sides of that equation. But I think that’s still the basic story that I’m getting and you know the quick summary is she in today looks like a u.s. china cross border d t c apparel brand with uh… d t c apparel brand and retailer with surprisingly low prices and surprisingly effective digital marketing that’s my one-sentence summary thus far now if that was the only story going on here and i asked about competitive advantages we would come up with a sort of list of competitive advantages that are pretty standard for a retailer. We would look at share of the consumer mind. What hold do they have over their consumers? What is their brand loyalty? Do they have captive customers? Do people click into their website every day, every hour? If it’s Walmart, do they come to the store every weekend? We look for that sort of demand side power. The other one we’d look at, we’d start talking about economies of scale. And if it’s a, you know, the big one of retail, if you’re a retailer, not a marketplace, they’re buying the goods and then selling them, not just enabling transactions and taking a fee. Now within economies of scale, we’d look at purchasing economies. You know, because they are large in their market versus a competitor, they can get lower prices from suppliers relative to a competitor, and then they can pass those… savings on to consumers as lower prices or they can keep those savings to themselves and outspend their competitor on things like marketing. So, you know, that would be the JD story for a long time. Strong presence in the consumer mind and also very powerful purchasing economies that make prices lower. That’s also the Walmart model. There’s a lot of these, there’s not that many retail brand business models I really like that much but most of them that I like do have this sort of play. Other things we might see if they have physical stores and warehouses, we’d start talking about logistics density as a type of economy of scale. Don’t worry about that for today. We also might look at their spend on IT and marketing. That’s something JD is definitely doing. JD is really pulling all of those levers. They have powerful sort of share of the consumer mind because of their scale advantage, they got purchasing economies. They’re outspending their competitors on IT and logistics and R&D actually. And then they’re starting to get logistics density and sort of neighborhood by neighborhood. They’re pulling all of those levers. Now, looking at Shein that way, we would definitely see the first one, share of the consumer mind would be a question. We’d see purchasing economies, probably. And we’d probably, since they don’t have stores and they probably don’t have too many warehouses, They’re not building warehouses all over the world. It’s probably a handful, an outbound one in Guangzhou and a couple inbound ones per country, things like that. We’d probably look at their fixed cost spending in IT and R&D. That would be the story I’d be thinking about. However, that brings us to the next topic, which is this idea of, is there 1,000 new products per day thing? Are they sort of creating a new business model or at least a new advantage? based on being super fast, ultra fast, real time fashion, as opposed to Zara and H&M, which did quite well with fast fashion, are they creating something new here that is really gonna give them a new source of power and advantage in all of this? And that’s kind of what people have been talking about with this company, and I think, for those of you who are subscribers, you saw my note on this, and I basically said, look, don’t get all gaga about the business model. and ultra-fast fashion questions. You know, today this thing is mostly about very low price DTC apparel brand. That’s most of the story. But this could be emerging, it could be becoming a major thing, it may be a major thing, but I think people are going a little bit gaga over this sort of business model question. What I’m kinda hearing is an argument that goes something like this. Apparel and fashion are very big, but it’s a retail sector with a lot of sort of unusual characteristics like high return rates, very regional, even city specific tastes. There’s lots of fads. It’s really hard to predict demand because trends change quickly. Fads happen all the time. Influencers, fashion houses influence demand. So the demand is always changing shape and it’s very hard to predict that, which means it’s also very hard to do your inventory and supply chain. And so you end up buying clothes that don’t sell and then you’ve got to mark them down. You have inventory obsolescence, things like this. And for everyone who went to business school, you probably studied Zara. It’s a very famous Harvard business case. And the idea was Zara fast fashion, by being much quicker in our cycle times, i.e. we gather data on what people are buying in the store. And based on that, we design new clothes. We manufacture them, we ship them, and we get them on the shelves very, very quickly. And by doing that, we’re responding faster to changes in demand. We can dial up production of popular SKUs faster than our competitors, and we can dial down production of ones that aren’t as popular. Now the net result of just sort of being faster in that way is you basically get a bump on both lines of your income statement. Your revenue goes higher, and your cost structure goes lower. The revenue goes up higher because you’re selling more because you’re giving people what they want. And your cost structure goes down because you’re reducing inventory waste, you’re reducing inventory markdowns and costs and things like that. And so Zara’s fairly famous for being able to update its products throughout the sales or fashion season. You know, they don’t place an order and then three months from now that’s within the stores and they hope they did well with the fall season. They update every two weeks during the season and they design new items, manufacture them, and get them in their stores. People say two weeks, but it depends where they’re shipping to. But this is historically why they’ve based their manufacturing in much higher cost northern Spain as opposed to China, which is where H&M does it. So anyways, that’s kind of classic brief summary as fast fashion. Well, the argument is Shein is taking fast fashion to the next level. Well, actually two levels above. You know, one, it’s online. There are no physical stores. There are no distributors. It’s just boxes. And then two, they’re doing sort of real time data-driven matching and personalization where, you know, they’re so tight on the matching of their webpage that that’s how they’re seeing what people are buying, producing. designing, producing, manufacturing, and getting a thousand new products up on their webpage every single day. So that’s why that sort of factoid is important. Now, I think they’re obviously doing that. My question is, is this a moat that they’re building or is this just going to be the new table stakes for doing DTC apparel? That every DTC apparel company or even just regular retailer is gonna have to act this way because that’s just how fashion and apparel retail works now. You just have to be fast like that. Or is this something a little more powerful than that? Now, I’m not really sure. I’ll give you my sort of standard framework here, which is, for those of you who’ve been listening for a while, my six digital superpowers. This is just a little list I use. It’s just a simplification. And I find it to be a pretty good thing to check when they’re at, because I’m looking at when something emerges that is sort of a digital capability or tool. Is this just normal advancement of technology that every competitor is gonna do? You know, every bank has ATM machines, every bank does this. I mean, it’s just, yeah, there’s a lot of new tech, but it’s kind of table stakes and everyone just has to do it and it doesn’t give you any particular competitive power over anyone else, because you got there first. Or is this really a source of power where it’s a game changer, which is why I call it a digital superpower? and my six and I’ll put my little slide in my list in the show notes but you know I’ll just run down them you know for those of you who’ve been listening for a while you’ve heard me do this many times I find it really helpful you know it’s just a simplification obviously but it’s not bad and number one does it dramatically improve the user experience and user can be consumer it can be merchant it can be content creator depending what we’re talking about and yeah I think I think what she did dramatically improved the user experience. Lots and lots and lots of apparel products at really low prices and consumers love that. They really do. The selection is huge, the prices are low, everyone’s talking about the low prices. That’s a powerful move. I love, you know, I love, you want to get quick adoption with anything in this world on the consumer side. find something people are already doing and make it much cheaper. You know, that’s WhatsApp. Hey, you used to pay for your text messages, now they’re free. Took off like a rocket ship. Okay, so yes, I think it’s dramatically improved, but I think it’s going to be copied very, very quickly by others. There’s a lot of manufacturers in China. There’s a lot of companies that can tap into that. Now this is like, if I’m making, I don’t know, shampoo or tennis shoes in the US and I move my factory to China, Nike or Adidas, I am going to be cheaper than my competitors for a while, but they’re all gonna move their factories there too. It’s kind of a short-term advantage. So yes, but I think it’s good for adoption, it’s good for getting them into the game and breaking into the market, which is important. I don’t think it’s gonna be a long-term source of advantage. Superpower 2, is this enabling a platform business model? No. It’s a pipeline. retailer. It’s a traditional online retailer. They could become one. They are in a position to become an online platform because of their adoption on the demand side. They could do, JD was the same way in 2008, but then 2010 and 11 they added a marketplace platform to their retailer and now they’re both. They could do that. They could do a C to M marketplace like Pinduoduo. So they could No, not really. Again, there’s what people call a data network effect, which I don’t really believe in, which is personalization and customization. That’s table stakes, everyone does that. Superpower 4, are they capturing other competitive advantages? Yeah, possibly. And this is what I sort of mentioned earlier. They look like they have potentially the standard competitive advantages of a very big retailer. Share of the consumer mind. Very good at customer capture and branding. And then economies of scale, which I’ve mentioned. Superpower 5, do they have virality or some other powerful growth hack? Not really. But they’re pretty good at the digital marketing size. Now number six is the one that surprised me. And this is why I like running my list. Because every time I run my list formally, I don’t just let myself think it in my head. Well, this is what I think. I make myself run the checklist. I always find something I would have missed. And this is the one I missed. Superpower 6, is it scalable? Yeah, it’s really scalable. And that didn’t strike me at all when I was first thinking about this. What is XIN really? It’s a collection of factories, fairly well integrated as far as I can tell within China, and then it’s software. That’s it. Well, the software bit scales pretty easily. I mean, and… They can open up these retail stores, their websites, their mobile apps in every country very quickly, because on the front end it looks a lot like YouTube, or it looks like Google or Facebook. It’s only on the back end that it looks like sort of a physical retailer. To some degree, they can scale globally in a way that Amazon can’t. That’s really interesting. And then, you know… one point people have been making, I think this was a Paki who said this, you know, they are somewhat culturally agnostic like YouTube and like TikTok where, you know, people in, I don’t know, let’s say Hong Kong or, well, I don’t think they’re in Hong Kong. Let’s say Mexico. I know they’re in Mexico. You know, the close people want in Mexico. They’re looking at them and you know, the software is kind of culturally agnostic. Whatever people are looking at, they will match it. and they will keep adding thousands of new products every day to match the demand they’re seeing out of Mexico City. And that will be different than the demand out of Sao Paulo and out of London and out of New York. So it is kind of nicely scalable. Anyways, I thought that was pretty cool. So that’s not a bad first pass of thinking. But let me put that aside. I want to sort of jump to another topic about rate of learning. And then I’ll come back and sort of give you my what I think my answer is at this point. So the other digital concept for today is rate of learning. So it’s share of the consumer mind, economies of scale, which I gave you a couple versions of that, and then rate of learning, which again is in the concept library. But there’s really two different versions of rate of learning. Actually, there’s more than two, but the two I think about a lot are rate of learning as sort of a operational marathon, you know, to build up competitive strength and defensibility, which is what I focus on. You know, you have to kind of wind at two levels. You have to, as much as you can, build up motes and structural advantages, competitive advantages. And also you have to have operational speed and excellence. And I’ve given you my sort of standard smile marathon. Basically you have to run a marathon and you have to run it well and you have to run it fast and that gets you operational speed and excellence. But you have to choose a marathon. There’s lots of different types. You can’t do everything well in life. I’ve given you the SMILE Marathon, which stands for S-M-I-L-E, which is an acronym. But there’s others that people could come up with. But those are sort of the five that I think about, where I think digital is changing the game and adding new dimensions to competition. And here’s within SMILE, the L stands for Rate of Learning. So Rate of Learning can be an operational marathon as well as a type of mode. Now, I’m writing a lot about this right now for this book I’m working on, which is what I’m doing hiding out here in Mexico while waiting to get a shot. If you think about rate of learning, it’s been around for a long time. If you go back to Henry Ford, Model T, mass production, everyone talks about, oh, the industrialists, the big producers of cars and railroads back in the 18… 1880s, 1900, you know, Henry Ford later. Everyone talks about economies of scale. That was the big advantage. By getting bigger than your competitor, you started to get cost advantages as well as advantages in specialization and other things. That’s true. But there were other advantages they had with that sort of factory industrialist model and when you get to be that big. And one of them was rate of learning, which was as you do more and more of something, which is a static process, like. You’re not doing a hundred different things, you’re doing three things over and over and over and over. He usually has to have some level of complexity to it. As you do it over and over and over, you get better at it. Your factory gets more efficient, your people get more specialized, it becomes fine-tuned. And what happens is your cost per unit decreases with cumulative volume or cumulative production or cumulative experience, depending on how you wanna define it. And this is something that people you know, like the Boston Consulting Group have been looking at this forever. And you can see this, you know, back in the days of Henry Ford making Model Ts. The stat I got from the Boston Consulting Group was the cost of producing a Model T car fell by 25% for each doubling of cumulative production. Okay, so that’s kind of how a rate of learning would get you a cost advantage over time. And… We could call that type one learning, because it turns out there’s multiple types of learning, but that’s kind of one, it’s kind of interesting. Not totally relevant for this conversation, but I wanted to tee up the discussion. Type two learning, this is Steve Jobs land. You can call this dynamic learning. Steve Jobs wasn’t really good at making an iPod and then making it cheaper and cheaper and cheaper as they made more and more and more of them. Tim Cook was actually quite good at that. He was at the COO. What Steve Jobs was good at was dynamic type two learning, which was he would be good at launching the next product. So he would do the iPod, but then before the iPod even became obsolete, he would advance the iPad or the iPhone or the ITV. He was, his type of learning was sort of jumping by experience from products that were more advanced and built on the other. So again, it was kind of about cumulative. volume and he was getting the marginal cost decrease we saw in type 2 but you could say the early days, well not the early days, let’s say 2000 to 2010 of Apple the story was Steve Jobs doing type 2 learning, dynamic learning and Tim Cook his COO doing type 1. And then after Steve Jobs passed away, Tim Cook hasn’t really been doing any of this. Have you noticed that they don’t really launch new products anymore? So I think that’s kind of… interesting to mull over. Now would you call either of those a competitive advantage? It’s definitely an operational marathon. This is a dimension that you need to be able to compete on depending what sort of business you’re in. Like fashion. Fashion by its nature, as I kind of just teed up, is lots of changes. Very hard to predict demand. What people want, the trends, the facts, is always changing. So you have to learn very quickly and adapt to that. Rate of learning is sometimes put under the title of adaptive advantage, which is something Martin Reeves over at BCG wrote. He did a book called Adaptive Advantage. So it’s this idea of, well, you can adapt quickly, that’s an advantage. Well, it’s kind of learning as well, and people say, well, it’s experimentation, too. Prediction. All these words kind of get jumbled together. Adaptive, prediction, experimentation, Everyone uses different terms. I put it all under the sort of dimension of rate of learning. That’s what matters most. That you can kind of do this and type one and type two. Fine. Is that in a moat? It’s definitely an operating advantage. I tend to view it in practice mostly as a short-term moat. That if you do this well, you get some cost advantages. Maybe you stay ahead of the competition, but they will catch you. So I generally view it sort of as a an operating dimension and a short-term advantage. but it’s a little complicated. Okay, then we get to the point, finally. There is this idea floating around, which is really interesting, which is the idea of type three learning. And type three learning is also called learning at the speed of algorithms, which was the title of this podcast. If Sheehan is doing DTC apparel at the speed of algorithms, what does that mean? Well, how do you learn? How does an organization learn? How do people learn? How does the operation learn? Well, it used to be you’d look at numbers and you’d do data analysis, and you might do meetings and planning and all of that. But the rate of learning was very much set at a human speed. We think in terms of days, might think of months to launch new products, to make changes, things like that. And over longer term strategy, something like Elon Musk is very good at, He thinks in terms of decades. Well, there’s another time scale here. What if you can learn in milliseconds? What if your operation can adapt and adjust and learn in milliseconds? Is that a new thing? That’s kind of interesting, because software can do that. It can see data, it can learn, and it can make decisions very, very quickly. And this data can be gathered from all these things we see proliferating in the world. Cameras, video cameras, IoT sensors, robotics, webpages, apps, all this data that is streaming in all the time now increasingly is being able to be seen by software, particularly AI, and it can analyze it, learn, and make a decision in milliseconds. That’s how a Tesla moves down the freeway at 60 miles an hour. It takes in the data. it analyzes, it learns, it makes a decision. We’re gonna shift lanes. So what happens when you build that in to a DTC apparel retailer, which I basically think is what Sheehan has done. And that’s a really interesting idea. It’s fun to think about in Martin Reeves, the BCG chairman of the Henderson Institute. When I had him on the podcast and I kind of asked him, like, what do you think is the most interesting thing going on? Because he thinks a lot about competition. And he basically said this idea of competing on different time scales. And that good organizations may need to compete on multiple time scales at the same time. Milliseconds, days and weeks, years. And you might use different tools for each. You might use algorithms for one. You might use humans only for another and you might use a mix. And it’s a really interesting thing to think about. So let’s say that Sathers White Sheehan is doing. The thousand new products they are launching every day are a real time learning at the speed of algorithms and that’s what’s going on and they’re getting better at it and they’re not just learning overall they’re learning about what people in your city want right now as opposed to a month ago as opposed to yesterday not just your city maybe your block Maybe they’re learning person by person by person in the world what they all want in real time and making decisions and as they ramp up their design production and shipping capabilities out of China, which is their building, maybe they’re getting faster and faster on both sides and they’re doing this globally. Hmm that’s kind of interesting to think about. Now they still, learning at the rate of algorithms or at the speed of algorithms is one thing. You can’t match that. I mean, you can’t just shoot out the product and it goes out in seconds. I mean, it takes days to design and manufacture and they’re really fast at this, like Xara, but then they have the shipping time as well. But I think once you’ve got it up on the web page, you’re in pretty good shape. That’s kind of when decisions are made. So let me cycle back and we’ll sort of finish up here with my first question. Sheehan is doing DTC apparel at the speed of algorithms. Is that a moat or is that just new table stakes? And my take on this, I’ll give you my answer, but I’m still thinking about it. I don’t think anything I’ve just said in terms of rate of learning, business model, all of that, I don’t think that explains the recent meteoric rise of Shien. I don’t. I think the factors that launched them upward are kind of what I said at the beginning. Look, they offered acceptable quality, really, really low priced apparel. to US consumers and that just was a big hit. People loved it, they had some questions about the quality and you can see people writing web pages, it’s that wedding dress story. I think that’s the biggest single lever here by far. It rocked them into the space and that’s great because competitive advantages and modes typically come later. It’s tactics and moves like this that let you break into a space and then you try and solidify your position. So that’s great. and you know looks really interesting. That was kind of the biggest thing. Second thing, they’re just really good at social media, KOLs, influencers, TikTok, and they were at the right place in the right time. Right? I mean they were right there when social media took off. They were on TikTok early. Based in China you understand, not say you understand these things better, but you know the social media influencer integration with e-commerce is so much more sophisticated there. that they already understood this stuff when they saw it percolating in the US. So they jumped on that. They probably got a big boost out of that. Factor number three, they really got traction with the next generation, which is Gen Z, and particularly basically young women. Who, what do young women want? Well, not what do young women want. What does this demographic that seems to like Shien want? They seem to like to look at lots of clothes at very low prices on their smartphones. That seems to be the winning formula for that particular demographic thus far. They jumped in, they got them. Getting to a demographic early is a heck of a lot easier than trying to convince a demographic that’s already using another site to switch. They got their, I mean, that’s pretty much what Pinduoduo did in China. They went after this fifth tier city, fourth tier city demographic. They got their first. and they gave that group exactly what they wanted, which was household staples at very, very low prices that you could buy on your smartphone. That’s exactly what that demographic wanted. They gave it to them, they rocketed upward, and suddenly China had another major e-commerce player. That to me kind of looks similar to what Xi’an is doing. And last factor, I think they avoided the competition. The best way to win is of… is don’t compete. I mean, go where people aren’t. That’s really the best strategy. The second best strategy is if you have to compete, try and compete with people that suck. Like, you know how you win at tennis? Play people that suck. It’s the easiest way to win at tennis. Elon Musk is struggling in cars much more than he is in rocket ships. Why? Because in cars he’s competing with Volkswagen and Toyota. In rocket ships, he’s kind of competing with government, contractors who aren’t terribly competitive. It’s an easier fight. Anyways, I think they have they avoided the competition and This is just a guess but I’ll put it out there. Why are they so quiet about what they’ve been doing? Well, they’re not the only DTC apparel brand in China. They’re all over the place in China, but they avoided the brutal Battle Royale type competition of domestic China DTC apparel by going cross-border into the US they went where? They basically limited most of their competition by focusing on that. I think that’s what they, that’s how I always, that’s what literally I recommend to companies all the time in China. Keep one foot here and one foot in the US or Europe or Africa or Latin America or somewhere else because you’ll eliminate most of your competition with that. And the domestic market is really brutal. So I think they did that. Anyways, I think that’s most of what was going on in the last couple of years. But, Are they doing something that can’t be copied? This rate of learning thing. Does it matter? And I’ll tell you my answer. My working answer, I think their biggest moat going forward is customer capture, branding, share of the consumer mind. Because I think that’s where most retailers live and die. How many people come into the Walmart store? How many people check in with JD? I think that’s the biggest lever and they’re definitely building there as much as they can. I mean they’ve got notifications and gaming and points and sign up and loyalty and blah. I mean they’re trying to lock that in and they’re building their brand very very quickly and that’s great. That’s probably their strongest moat long term. They have an advantage in purchasing economies. I think that’s going to be temporary because I think anyone can buy goods from Chinese manufacturers. The logistics cross-border bid, which you could argue is a type of economy of scale. Nope, don’t think so. If share of the consumer mind is number one. Number two I’m looking at is their IT spending. The global scale of what they’re doing may put them in a position to outspend literally everyone on their IT. That they’re building more sophisticated matching and real-time analysis and rate of learning. than anybody because I mean, they’re opening in hundreds of countries very, very quickly. And most retailers don’t do that. I mean, most retailers are regional or maybe national. There are very few global retailers. Most of the global digital companies we talk about, TikTok, YouTube, I mean, they’re media companies and they’re communications companies. They’re not retailers. So I think their IT spend is really interesting as a sort of… economies of scale competitive advantage on the on the supply side. Now, rate of learning as an advantage. I think it’s mostly a temporary advantage right now. I think it’s mostly table stakes right now. I think a lot of retailers are doing what they’re doing. I don’t think their matching is all that unique. I think a lot of companies are doing this. I think what they’re doing cross border makes them unique, but not the idea of we’re doing a lot of real time matching as they are. So I think it’s an operational dimension. I think it’s important. I think it’s a strength. I don’t see it as a moat at this point. I think it’s gonna be copied. But we’ll see. I mean, I’m totally willing to be proven wrong. That’s kind of where I fall on this right now. But I’m watching, because I’m really interested in this question of when rate of learning becomes a moat versus just sort of standard operating performance. Okay, that’s my take and concepts for today. Share of the consumer mind, economies of scale, rate of learning, which can be either an operational dimension or a competitive advantage in some cases. As for me, I’m having an interesting week. I’ve been in Juarez, Mexico for a week. I’m basically just staying across the border to get this shot tomorrow. I’m kind of looking forward to getting that over. That will be the second dose of Pfizer. And then I’m done. Although I hear that it really wipes you out. So I’ve got literally nothing to do for the next day. I’ve downloaded a bunch of movies. I am fully prepared to just be zonked out for a day. And then I’m gonna get back on the road and probably spend a couple weeks in Mexico City because the quarantine rules of Thailand have been increased. So it’s now 15 days if I fly back to Bangkok that I’ve got to sit in quarantine, which I don’t really want to do. It was seven when I was preparing to leave, and now it’s 15. So I think I’m gonna hang out for a month or so floating around Mexico, maybe bounce down to Brazil. I’m kind of mulling it over. I’m writing books. My book on competition meets digital, which I’ve obviously been focusing on for a long time. I’m writing that up. I’ve just been hanging out in cafes. The last three days I did four chapters in 20,000 words, which is if you’ve ever written a book that’s actually kind of a lot of writing. It’s certainly much faster than I’ve ever written before. It turns out that if you write a book based on 700 articles and 90 hours of lectures that you’ve already done on the subject, it’s pretty easy. I’m just doing a lot of cutting and pasting. It’s a heck of a lot easier than the last couple books. So yeah, that’s been my day. And Juarez is kind of, you know, it’s interesting. There’s not a lot going on here. Juarez, if you’re not familiar, if you ever saw the movie Sicario, where it’s like… drug cartels and all of that. Well that’s the border town right across from El Paso and it was not portrayed terribly nicely in that movie. It’s actually, you know, fine. I mean there’s not a lot to do but it’s not, you know, I’m hanging out at Starbucks and going to the mall and having lunch at Denny’s so it’s, you know, it’s nothing like the movie but you know it ain’t exactly a tourist city either. So that’s me. It’s been an interesting week. I hope everyone is doing well. I hope this is helpful. If you have any suggestions for companies, please send them my way. I’m always looking for new stuff to dig into. I appreciate those of you who have done that. That’s a real big help. But other than that, hope you’re doing well. Take care, and I will talk to you next week. Bye bye.