I’ve spent the last couple of weeks in Brazil, touring around giving talks. Joseph Teperman of Inniti has been awesome in coordinating visits for me in Sao Paolo, Florianopolis, Belo Horizonte, Vitoria and Porto Alegre. And I got to meet some great folk at the Instituto de Lideres. It was a fantastic trip.

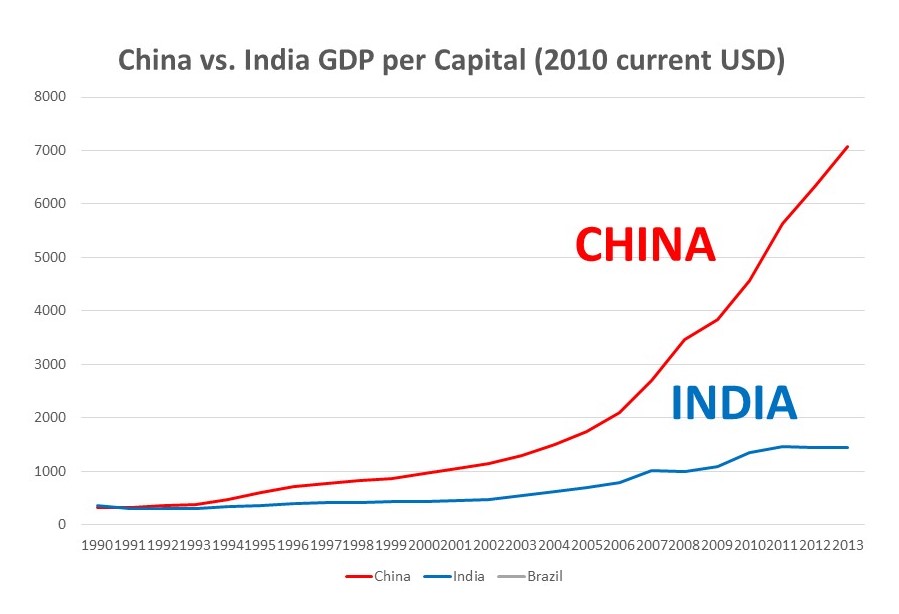

One of the questions that keeps getting raised is what Brazil can learn from China. And for me that comes down to one chart, which is shown below.

The red line is China and the blue line is India. And the difference is important because both countries were very similar in 1985-1990. They both had large populations (about 1B), low GDP per capita (about $1500) and large geographies. So the question of what can Brazil and other developing countries learn from China is “how can you be more like the red line? And less like the blue line?

My answer to that is basically three points:

Point 1: Compound wealth consistently over 20-30 years.

China began to grow faster in wealth (GDP per capital) than India in 1990-2000. It happened slowly at first and then much more rapidly. And if you look at the shape of the red curve, it is basically an exponential. It is now accelerating away while India has remained relatively linear in its growth. China now grows by the size of India about every 2-3 years.

My simplistic explanation for this is wealth compounding. That is what the red line looks like to me. And that was what Warren Buffett said when asked about China. His said (approximately) that China has figured out a “secret sauce that lets them compound wealth”.

Compounding is awesome

I like superhero movies. I watch all of them and I grew up reading comic books. But I know of only 3 superpowers you can actually have in real life. One is deep expertise in mathematics and / or software (you can figure out almost anything). The second is is jiujitsu (you can beat up almost anyone). And the third is compound interest. That if you grow consistently over time, then the base increases and the wealth starts to grow exponentially. My favorite explanation / example of compounding is that if you fold a piece of paper in half, you double its width. If you do it again, you double it again. If you do it 47 times, you will cover the distance between the earth and the moon.

Well China has been compounding for 30 years. They have consistently grown at 5-10% per year and that is what is now accelerating in an exponential fashion. You don’t have to have massive growth – but you have to be consistent over 20-30 years. And China has done this. The US also does this. So does Warren Buffett (note: like +90% of his wealth happened after age 50). But many / most developing economies have not.

Point 2: Let the ambitious break the rules

I spoke with folk in Brazil a lot about this. Because one thing that Brazil and China have in common is a dominant role for the State. China is rightfully known as the ‘land of licenses”. And Brazil has a government that accounts for something like 45% of its GDP. So why has one State-dominated country has shown such dynamism and the other not?

There are lots of reasons and it’s not my area of expertise. But cool difference is that the Chinese government (at local, province and national levels) will frequently let the ambitious and innovative blatantly break the rules. Some examples:

- Bike-sharing resulted in probably 12M bikes being placed around Chinese cities. This was not technically legal and they didn’t really ask permission. The companies just sort of did it. And the city governments just sort of let it happen. That’s pretty amazing and something you could never do in New York or London. My impressions is they didn’t want to stymie these companies and they let them more or less break the rules for a while. The first regulations on this really got applied about a year later.

- Didi and Uber had an epic battle in Chinese ride-sharing in 2016. They both spent +$2B in driver subsidies and we all got cheap rides for a while. And during all this, ride-sharing was still not really legal in China. Again, the government let it happen and the regulations happened later. Actually ride-sharing was technically made legal around July 2016 and then some serious regulations came shortly after that.

Point 3: Digital transformation / disruption is your most powerful tool.

Another story I told around Brazil was about the launch of Yue’Bao, Alibaba’s money market fund. Back in 2012, there were really only 4 big banks in China, the big State-owned giants. They offered basic products. Services were ok. But they were not known for convenience, ease of use, or awesome online services.

Then Alibaba launched Yu’e Bao, which enabled Chinese consumes to use their PC’s and smartphones to invest money. Very easily. Without restrictions and in a way that was exceptionally easy to use. Plus they offered higher interest rates.

And Chinese consumers moved in huge numbers. They moved over $80B in about 6 months. By 2017, assets under management had grown to $165B, making it arguably the largest money market in the world.

Yu’e Bao is a story of new digital tools being used to give consumers what they really want, especially convenience. It is also a story about how digital tools can disrupt and transform stagnant, slow-moving and still developing industries.

So for a country like Brazil, with an entrenched State, digital tools and disruption are a capitalists’ most powerful tool. Don’t try to reform the under-developed or politically sclerotic industries. Just disrupt them. Use new digital tools to bypass the system and go straight to consumers. Offer consumers greater options, greater convenience – and they will probably come running in huge numbers.

***

That’s my take. Thanks for reading. Note: I shot a video around Rio on this topic, located here.

I’m back in Asia now. Cheers from Manila,

-jeff

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.