A final post on Uber China.

In Part 1, I argued that Uber China was now on the wrong side of both the government and entrenched local competitors. Their best option is to partner with local governments or State-owned taxi companies – thereby removing the government problem and trumping the powerful economics of their competitors.

We see similar situations in banking, insurance, telecommunications, and other State-infused sectors. These situations can be confusing but can also be some of China’s most profitable sectors. Active State involvement usually mean less efficiency – and therefore bigger profits, sometimes.

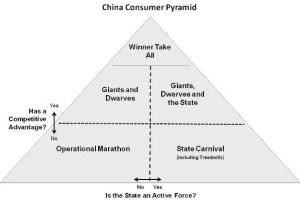

The key is to ignore the confusing day-to-day competitive moves and to identify the longer-term forces that will shape the industry structure. My argument is that for Uber in China, the two dominant forces are the presence of a strong competitive advantage and active State involvement. This is shown below and I call this long-term outcome “Giants, Dwarves and the State”.

In this scenario, a few companies (the Giants) eventually end up holding large market share and are much larger than the other companies (the Dwarves). This follows from a competitive advantage (in this case, network economics) and usually means healthy profits and returns on invested capital (but not always).

However, the State is both policeman and big player here. Regulations can be extensive and rapidly changing. And they can favor certain parties. Local governments can be actively involved. And sometimes the State is a competitor through SOEs. These SOEs are usually strategically focused, as opposed to purely commercially-focused.

The key to winning in this situation is to figure out how to adapt to the State. Usually this means figuring out what the State wants, helping them achieve it and not sacrificing profits in the process.

Uber’s problem is that they cannot be a Giant in China now. Kuaidi and Didi have massive networks. They have 99% of China’s taxis and have now launched private car services similar to Uber. And as you don’t want to be a Dwarf, your options are to exit or partner with (i.e., marry) the State.

Looking at this situation, it is usually the government activity that is confusing for people. But to assess the impact of the State on competition, you really just need to answer five questions:

1) Is there a government-granted competitive advantage?

These can be licenses, patents, etc., – anything that creates a barrier to entry. In China, they are most frequently granted to strategic SOEs.

In the case of Uber, the answer is no. No parties yet have any sort of government exclusivity for taxi hailing or private ride sharing.

2) Are strategic SOEs competitors?

Are you trying to compete in mobile with China Unicom or in banking with ICBC? If so, you are basically competing with the government.

In the case of Uber, there are no strategic SOEs in transportation apps yet but they are now starting to appear. A couple of city taxi companies (state owned) have launched their own local ride sharing apps. Guangzhou is the latest example.

3) Do the regulations / rules for the industry favor development? Do they favor particular parties?

The answer to this question changes over time and should be tracked. But the answer today is mostly “yes” for taxi hailing and “no” for ride sharing.

4) Are State-related assets decisive in competition?

If you take a resource / asset view of competition (as opposed to an economic forces view), then State-related assets can be a big deal. Who gets land, loans, legacy assets (factories, operating platforms, etc.), tax credits, etc. on their balance sheet can have a big advantage.

This question turns out to be the key for Uber in China thus far. Getting access to taxis, which are State-owned assets, has been critical. That is how Kuaidi-Didi have done so well. They coordinated early with local governments and that’s how they expanded to +350 cities in a couple years.

And in this case, these State-related assets gave them network scale that is likely decisive.

5) Are State-related capabilities decisive in competition?

A similar question but focused on softer capabilities such as technology transfer, government approvals, contracts from SOEs, etc. This is not relevant in this industry. It matters a lot in sectors such as construction and solar.

Based on these questions, you can say Kuaidi-Didi won by focusing on Question #4 and by keeping a close eye on Question #3. My recommendation for Uber is basically to change the answer to Question #2. Help create strategic SOEs in multiple cities by being their technology partner.

That’s quite a bit of theory. But I find these are pretty reliable checklists.

Last point:

In “Giants, Dwarves and the State”, management’s primary duties are to build the competitive advantage, to fight off the Dwarves (and new entrants) and to work with the State (usually strategic SOEs, regulators or local governments). And a joint venture with a strategic SOE or a local government is often the best approach.

For Uber, this will probably play out over the next year. Lots of talk about China growth and avoiding the topic of Kuaidi-Didi’s dominance. Absent a change in strategy, they still appear to spending a lot of chips on a losing hand.

—————